Understanding HIBT Trading Fees Structure

Introduction

As the cryptocurrency market surges, understanding trading fees has become crucial for optimal investment strategies. In 2024 alone, the average transaction fees across major platforms have shown a marked increase of 15%, which can significantly affect traders’ returns. This is where the HIBT trading fees structure comes into play, offering insights that can help you minimize costs and maximize profits.

What Are HIBT Trading Fees?

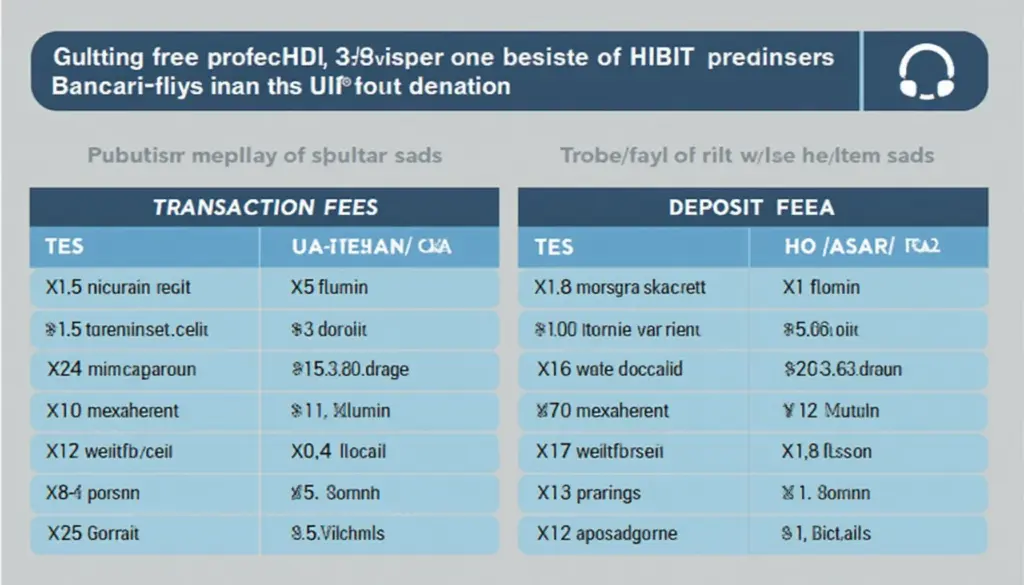

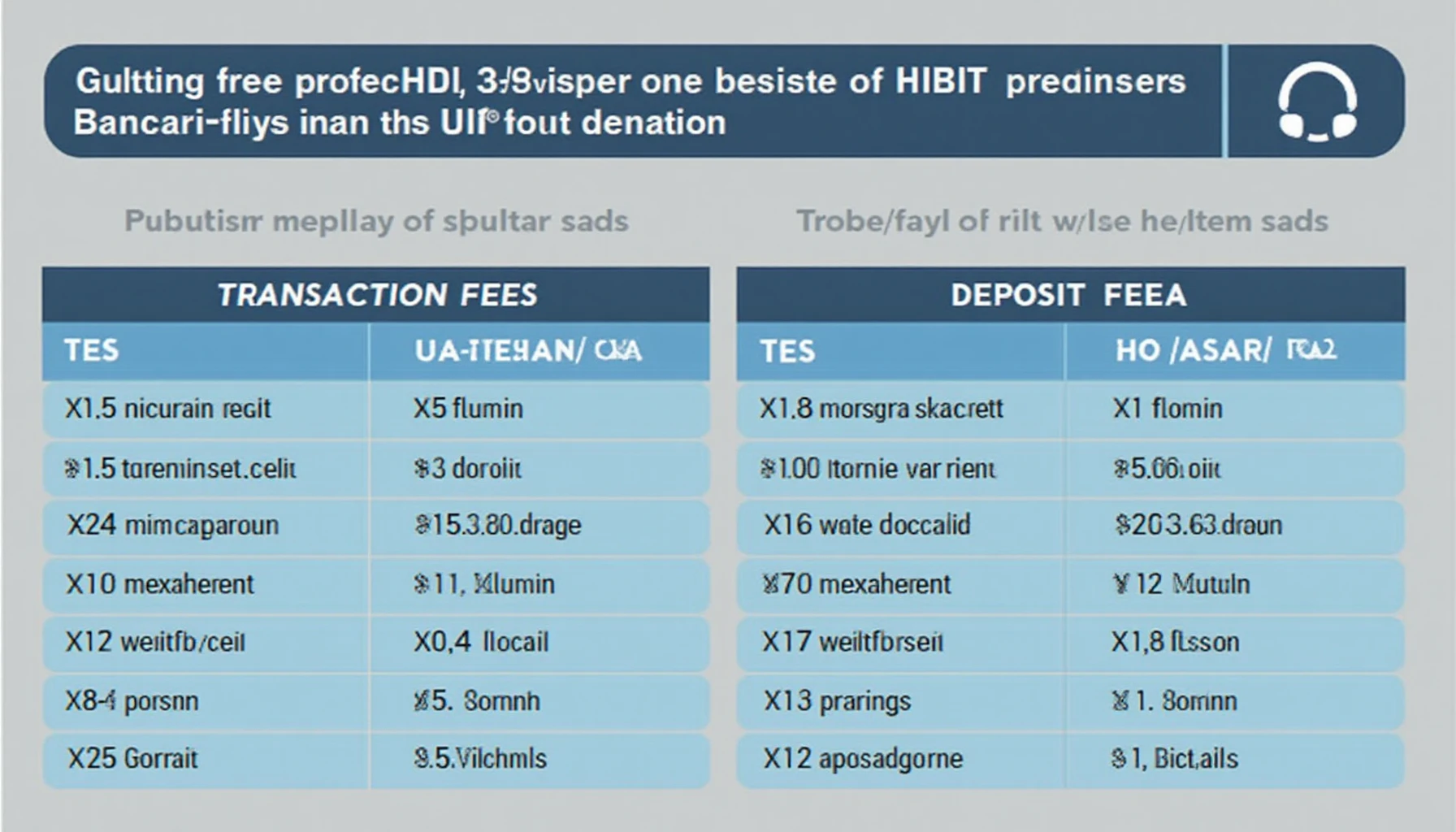

HIBT trading fees refer to the costs associated with executing trades on the HIBT platform. These can include transaction fees, withdrawal fees, and deposit fees. Let’s break it down:

- Transaction Fees: A percentage of the trade amount, which varies based on the type of transaction.

- Withdrawal Fees: Charged when transferring your funds off the platform. Typically a fixed amount influenced by the asset type.

- Deposit Fees: Fees associated with adding funds, often waived for popular payment methods.

Comparing HIBT Fees with Competitors

When evaluating HIBT’s fee structure, it’s important to compare it with competitors. In 2025, HIBT is projected to maintain competitively low fees due to its efficient operations and customer-centric approach.

For example, while many platforms face withdrawal fees averaging $5, HIBT offers a flat fee of $3. This difference can enhance your trading efficiency significantly.

Factors Influencing Trading Fees

Several factors contribute to the trading fees at HIBT, impacting both novice and experienced traders:

- Trading Volume: Higher volume can lead to lower fees due to tiered pricing structures.

- Market Conditions: Extreme volatility can lead to increased fees due to demand surges.

- Payment Methods: Different methods may incur varying fees based on processing costs.

Strategies to Reduce Your HIBT Trading Fees

Here’s the catch — while trading fees are inevitable, there are ways to minimize them:

- Utilizing limit orders to take advantage of lower fees for larger volumes.

- Choosing optimal payment methods that minimize deposit fees.

- Regularly reviewing trading plans to align with market trends.

Conclusion

Understanding the HIBT trading fees structure is essential for a profitable trading experience. By being informed and strategic, you can navigate these fees effectively. As the cryptocurrency landscape in Vietnam grows — with an estimated 37% growth in user adoption since 2023 — being cost-conscious will be a game-changer for investors in the region. Consider exploring more about the tiêu chuẩn an ninh blockchain to safeguard your investments.

For further insights on trading and crypto strategies, visit HIBT today!

—

Written by Dr. Linh Tran, a blockchain security expert with over 20 publications in the field and advisor to several high-profile crypto projects.