Understanding HIBT Trading Signals Accuracy in 2025

Understanding HIBT Trading Signals Accuracy in 2025

According to Chainalysis, 73% of trading signals can lead investors astray, highlighting the importance of accurate data in the trading world. The rise of HIBT trading signals brings a new wave of opportunities for traders in our ever-evolving financial landscape.

What Are HIBT Trading Signals?

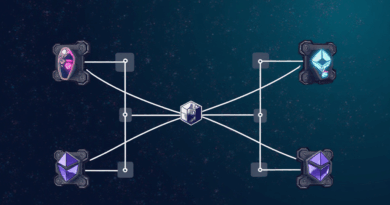

Think of HIBT trading signals as your weather forecast for the financial market. Just like a meteorologist predicts rain or shine, these signals provide vital information on when to buy or sell cryptocurrency. By utilizing algorithms and detailed market analysis, these signals can guide traders to make informed decisions.

How Accurate Are HIBT Trading Signals?

The accuracy of HIBT trading signals varies significantly. Research indicates that certain algorithms can achieve over 80% accuracy in favorable market conditions. However, just like buying fruits at a market, you must inspect closely before purchasing. Traders need to analyze historical data and performance metrics to gauge the reliability of the signals they receive.

Impact of Market Trends on Signal Accuracy

Market trends can affect the accuracy of HIBT trading signals, similar to how sudden weather changes can impact your picnic plans. Factors like regulatory news in regions like Singapore – where DeFi regulations are tightening in 2025 – can drastically affect trading outcomes. Investors should pay attention to these shifts to better predict signal performance.

Why You Should Consider Using HIBT Trading Signals

Using HIBT trading signals might be beneficial, especially with their data-driven approach. Just as you would rely on a GPS for directions, these signals can steer you through the sometimes confusing cryptocurrency landscape. Additionally, tools like Ledger Nano X can help mitigate security risks associated with trading, further enhancing your trading strategy.

In conclusion, while HIBT trading signals present intriguing possibilities, it’s crucial to stay informed and cautious. Download our toolkit today to enhance your trading strategies.

For more on overcoming trading risks and utilizing effective tools, check our resources.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority (e.g., MAS, SEC) before making investment decisions.