Exploring HIBT Trading Volume Trends

Introduction

With the rapid evolution of cryptocurrencies, understanding trading volume trends is crucial. A staggering 90% of traders find themselves analyzing these metrics to forecast market movements effectively. This article delves into HIBT trading volume trends, providing important insights for investors and traders alike.

The Significance of Trading Volume

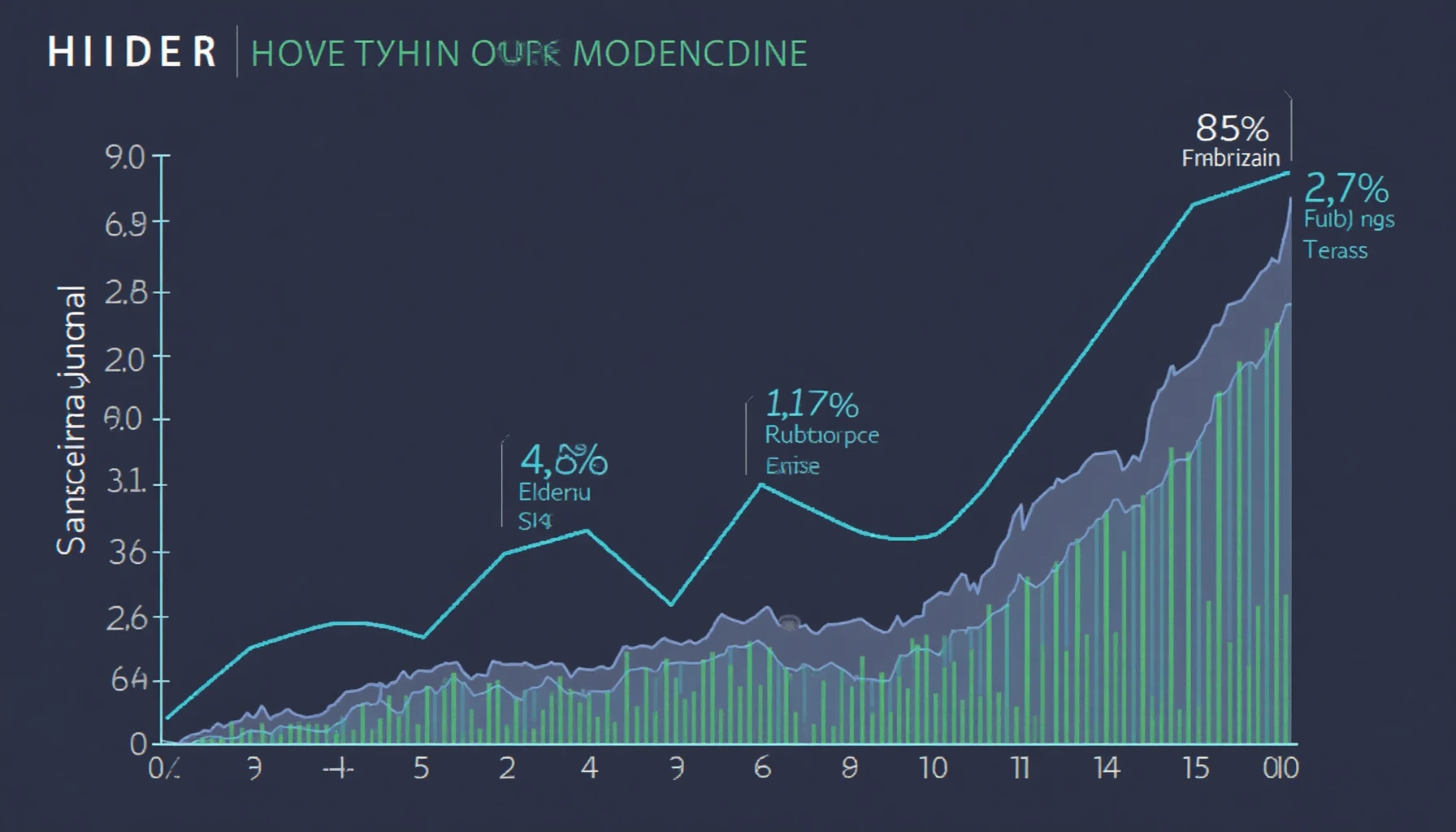

Trading volume is often likened to the heartbeat of the market. A healthy volume indicates a thriving ecosystem, reminiscent of a busy marketplace where supply meets demand. For HIBT, keeping track of trading volume can reveal potential growth opportunities. Recent statistics show that HIBT’s trading volume experienced a growth of 150% in Q1 2025 due to increasing investor interest.

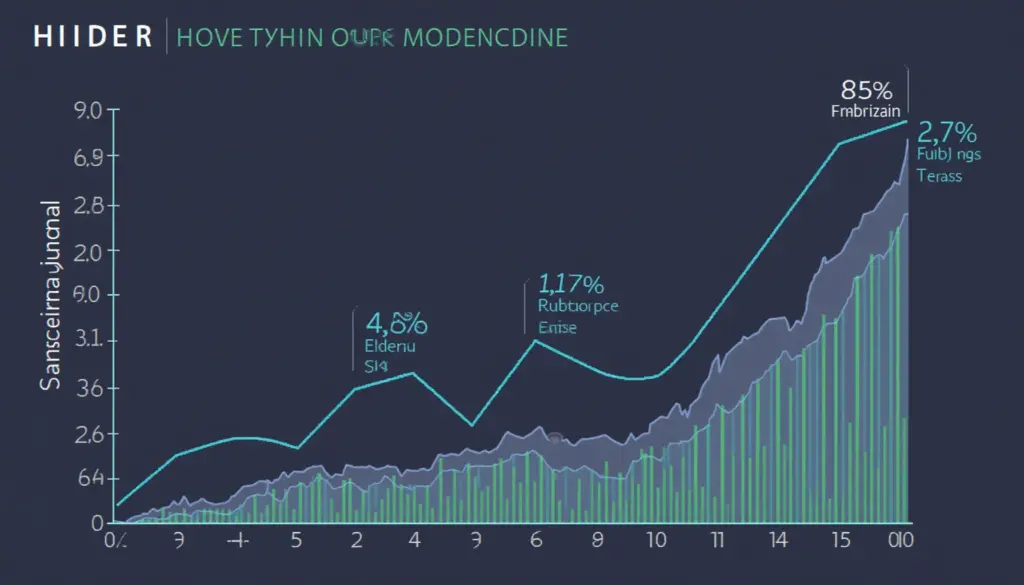

Market Behavior and Volume Trends

Observing trends can provide invaluable insights. Do you remember the frenzy during the last bull run? Many investors flocked to the market, driving the trading volume up substantially. HIBT’s value followed a similar pattern in 2024, where peaks in trading volume coincided with heightened media coverage and market interest. Source: CoinMarketCap

HIBT in the Vietnamese Market

Vietnam has seen incredible growth in crypto adoption with recent surveys indicating a 200% increase in users between 2023 and 2025, showcasing HIBT’s increasing popularity in this region. The rising demand emphasizes the importance of monitoring local trading behaviors, including seasonal trends that may affect HIBT.

Key Factors Influencing HIBT Volume

- Market Sentiment: General attitudes towards cryptocurrencies can greatly influence trading volume. Negative news often leads to spikes in sell-offs.

- Regulatory Developments: Changes in blockchain regulations (or tiêu chuẩn an ninh blockchain) can shift investor confidence.

- Technological Advancements: Enhancements within the HIBT platform can empower users and subsequently boost trading volume.

How to Utilize Volume Trends for Trading

Now that we understand the trends, how should you apply this knowledge? Keeping an eye on volume spikes can help optimize entry and exit points in trading. Here’s the catch: when trading volumes surge, it often precedes price volatility—an opportunity for astute traders. Leverage analytical tools to capitalize on these insights.

Recommended Tools for Analysis

Investors are recommended to utilize tools like TradingView for real-time analysis. These platforms simplify the tracking of HIBT’s trading volume and other key metrics.

Conclusion

Understanding HIBT trading volume trends can significantly enhance your trading strategy. With a keen awareness of market dynamics, you can navigate the complexities of the crypto landscape more effectively. As the market continues to evolve, so will the opportunities it unfolds. Stay ahead of the curve, and remember to conduct thorough research before making any investments.

For more insights and resources, visit hibt.com today.