HIBT Trailing Stop Strategies in Crypto Trading

HIBT Trailing Stop Strategies in Crypto Trading

With over $4.1 billion lost to DeFi hacks in 2024, safeguarding investments has never been more crucial. In this article, we will explore HIBT trailing stop strategies that can help you protect your assets in the volatile world of cryptocurrency.

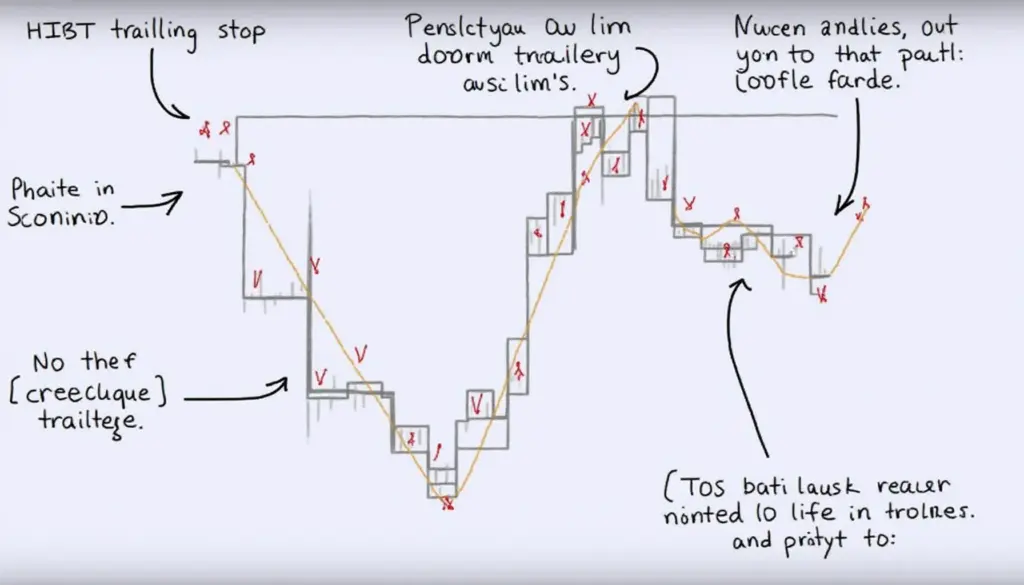

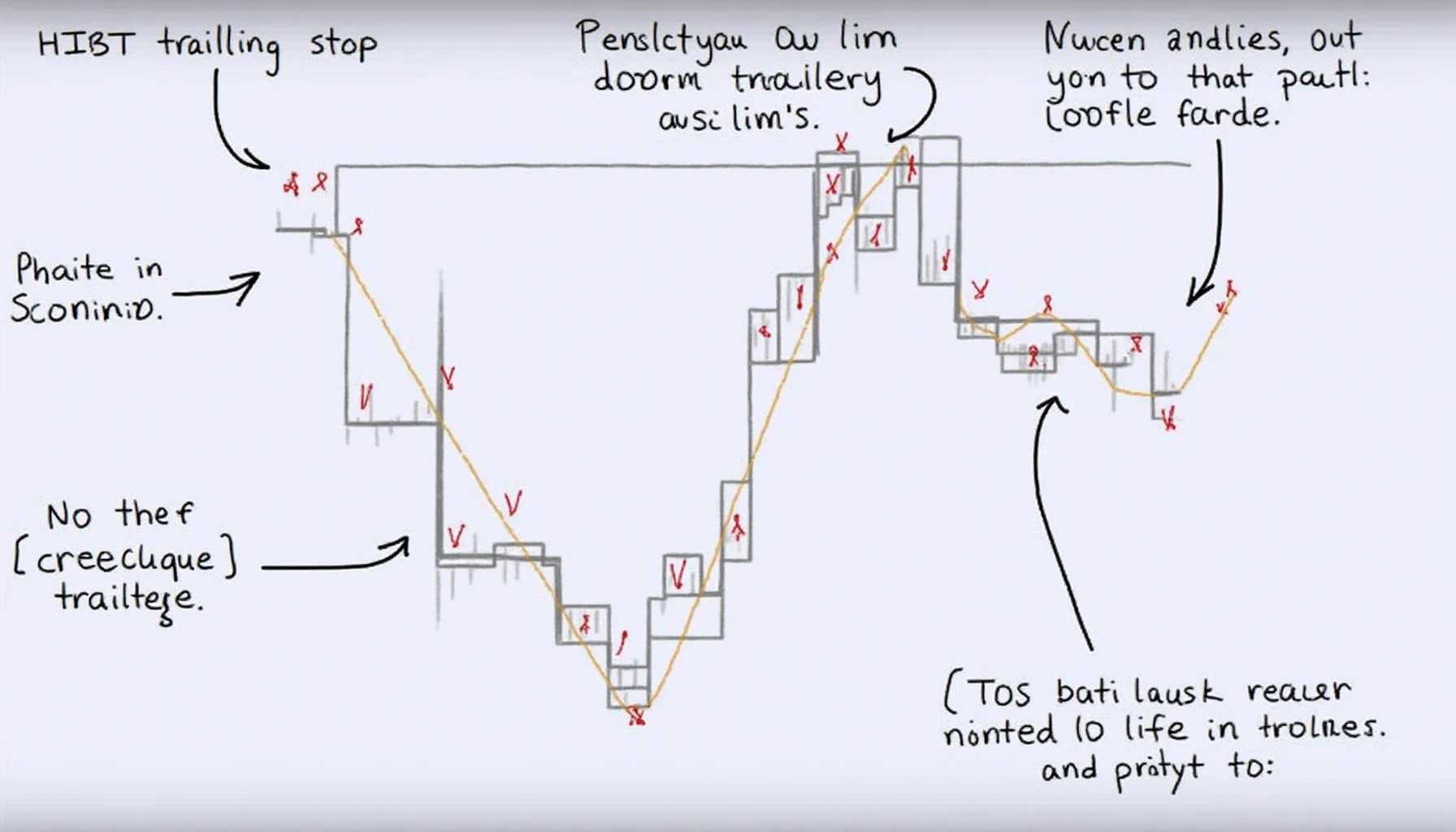

Understanding HIBT Trailing Stops

Trailing stops are a risk management tool that can be immensely beneficial for crypto traders looking to secure profits while minimizing losses. They adjust automatically as the price of a cryptocurrency increases, locking in profits as the market fluctuates.

Why Use HIBT Strategies?

- Enhanced Profit Protection: By utilizing HIBT trailing stops, traders can ensure their profits are safeguarded as the market rises.

- Reduced Emotional Trading: HIBT strategies take emotions out of trading decisions, allowing for more disciplined approaches.

- Adapting to Market Conditions: Like a bank vault for digital assets, HIBT trailing stops adapt to changing market dynamics.

Steps to Implement HIBT Trailing Stop Strategies

Here’s how you can implement HIBT trailing stop strategies in your trades:

- Determine your entry point based on thorough market analysis.

- Set your initial trailing stop percentage according to your risk tolerance.

- Monitor your trade regularly and adjust the trailing stop as needed.

The Role of Market Data in Strategy Optimization

Effective trading relies on accurate market data. According to recent reports, the Vietnamese cryptocurrency user growth rate was 30% in 2023, showcasing an expanding market.

By combining HIBT strategies with real-time data analytics, traders can enhance their decision-making process.

Utilizing Tools to Enhance HIBT Strategy Effectiveness

Tools such as trading bots can help automate HIBT trailing stops, making it easier for traders to benefit from market movements without constant monitoring. Consider using Ledger Nano X to secure your crypto and reduce hacks by 70%.

Protect Your Investments with HIBT

Implementing HIBT trailing stop strategies can be a game-changer for your trading performance. As you navigate the ever-changing landscape of cryptocurrency, using these strategies effectively allows you to safeguard your investments while capitalizing on market opportunities.

Don’t forget to explore additional resources that we offer to enhance your trading approach at hibt.com.

In conclusion, HIBT trailing stop strategies are essential in today’s digital investment environment. By integrating market data and employing automated tools, you can protect yourself against inherent risks.

For the latest insights on crypto investments and compliance, visit The Daily Investors.

Written by Dr. Nguyễn Văn Anh, a blockchain specialist with over 20 published papers in the field and a lead auditor for several renowned projects.