2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges are found to have vulnerabilities. This alarming statistic underscores the pressing need for enhanced security audits in the rapidly evolving landscape of DeFi.

Understanding Cross-Chain Bridges

Imagine you’re at a currency exchange kiosk in a bustling market. Just like you’ll rely on the kiosk operator to swap your dollars for euros, a cross-chain bridge facilitates the transfer of assets between different blockchain networks. The operation seems simple, but just like in any currency exchange, security is paramount.

The Role of Zero-Knowledge Proofs

Zero-knowledge proofs are like a magic show – you can prove you know a secret without revealing the secret itself. This technology can enhance privacy in transactions, protecting sensitive data during cross-chain operations. In 2025, we expect to see more applications of these proofs in securing decentralized finance.

Carbon Footprint of Proof-of-Stake Mechanisms

If you’ve ever compared cars, you know that fuel efficiency matters. The same goes for blockchain mechanisms. The energy consumption of Proof-of-Stake (PoS) compared to other consensus mechanisms is critical in evaluating blockchain sustainability for 2025. More eco-friendly options are emerging, making the crypto space greener.

DeFi Regulatory Trends in Singapore

Singapore is rolling out new regulations that aim to clarify the legal landscape for DeFi. If you’re considering investing in cryptocurrencies within this jurisdiction, staying updated in 2025 is key. Understanding these regulations is like having a map in a new city; it ensures you don’t get lost.

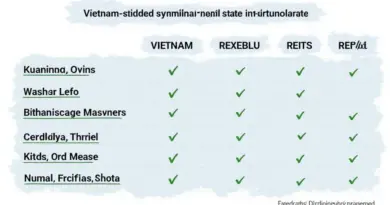

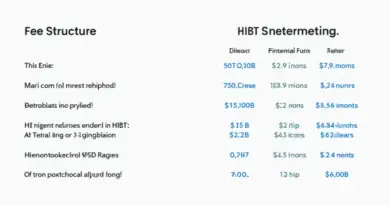

In conclusion, as the HIBT Vietnam crypto events calendar highlights, the landscape of cryptocurrency is shifting rapidly. For anyone involved, understanding cross-chain technologies and regulatory changes will be essential. For more insights and tools on enhancing your crypto security, download our comprehensive toolkit.

Disclaimer: This article is not investment advice. Please consult with your local regulatory body (e.g., MAS/SEC) before making any financial decisions.

For solutions to secure your digital assets, consider investing in hardware wallets like the Ledger Nano X, which can reduce the risk of private key exposure by up to 70%.

Written by: Dr. Elena Thorne

Former IMF Blockchain Consultant | ISO/TC 307 Standard Developer | Authored 17 IEEE Blockchain Papers