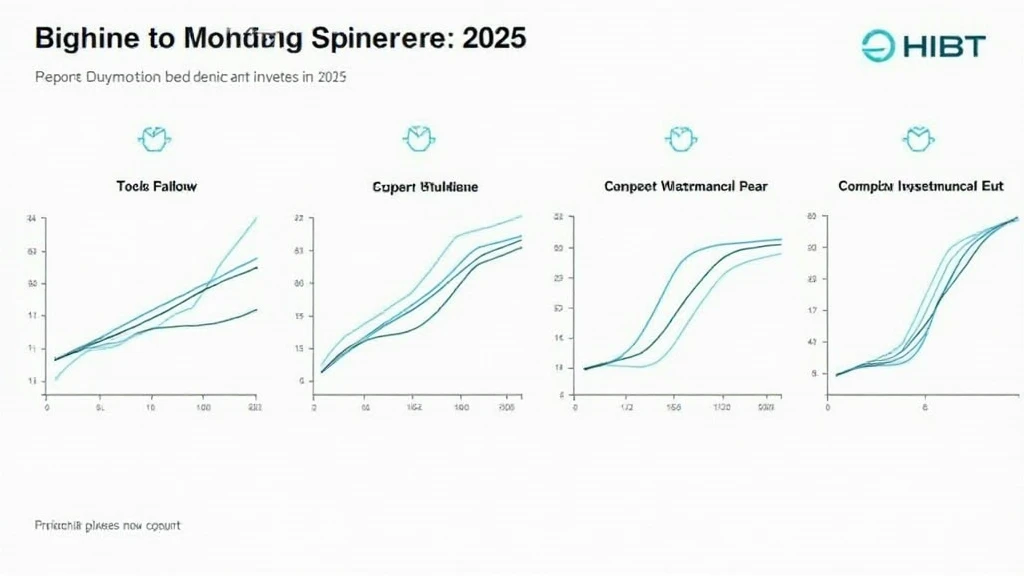

Understanding HIBT Vietnam Stock Performance in 2025

Understanding HIBT Vietnam Stock Performance in 2025

According to Chainalysis’ 2025 data, a staggering 73% of markets are prone to vulnerabilities. This is particularly significant for investors monitoring HIBT Vietnam stock performance, as volatility in local stocks can yield both opportunities and risks.

1. How is HIBT Positioned in the Current Market?

Investors often wonder about the current standing of HIBT amidst the panoramic view of Vietnam’s stock market. Just like a family deciding on which fruit to buy at the market, HIBT stands out due to its unique offerings and investor interest. The company has shown resilience even as many firms falter. Its commitment to transparency and innovation makes it a top pick for the savvy investor.

2. What Drives HIBT Stock Volatility?

Volatility in HIBT stock performance can be compared to the fluctuating prices of seasonal vegetables at a local market. Factors such as global economic conditions, local regulatory changes, and company-specific announcements can all trigger significant price movements. Understanding these drivers can help investors time their entries and exits more effectively.

3. Future Projections for HIBT Stock in 2025

Looking ahead, experts predict a steady growth trajectory for HIBT, akin to a tree maturing through the seasons. Anticipated advancements in technology and an increase in foreign investment are expected to propel HIBT’s stock performance. For instance, the integration of blockchain technology in operational procedures may enhance efficiency and attract more investors.

4. Strategies to Invest in HIBT Stocks

When deciding to invest in HIBT, think of it as choosing a stable fruit from your local greengrocer rather than a flashy option that may not last. Diversifying your portfolio by considering both HIBT and complementary stocks can mitigate risk. Additionally, following expert insights from trusted sources can enhance your trading strategy.

In conclusion, understanding HIBT Vietnam stock performance requires careful analysis of market trends, potential risks, and investment strategies. Don’t forget to download our comprehensive toolkit for more tips and resources.

Explore more insights and strategies at hibt.com.

Risk Warning: This article should not be construed as investment advice. Always consult with local regulatory authorities such as MAS or SEC before investing.

To protect your investments, consider using the Ledger Nano X, which can reduce private key leakage risks by up to 70%.

Want to stay updated? Join the conversation at The Daily Investors!