HIBT Vietnam Token Burns 2025: What You Need to Know

HIBT Vietnam Token Burns 2025: What You Need to Know

According to a recent Chainalysis 2025 report, over 73% of the existing DeFi protocols could be at risk due to inefficiencies and potential vulnerabilities. As the crypto world evolves, HIBT Vietnam is positioning its token burns strategy to mitigate these risks in 2025, contributing to a more robust ecosystem.

What Are Token Burns and Why Are They Important?

Token burns are like a bakery throwing away the excess bread that didn’t sell. This reduces supply and can increase demand, making each remaining token more valuable. HIBT Vietnam’s strategy for 2025 focuses on systematic token burns to enhance the value proposition for investors and promote scarcity in the market.

How Will HIBT Token Burns Impact Investors?

Imagine you’re at a carnival where there are limited rides available. As more people enter but the number of rides stays the same, you’re likely to value the rides much higher! For HIBT Vietnam, the token burns are expected to create similar scarcity, potentially driving up the value of each HIBT held by investors.

The Role of Blockchain Technology in Token Burns

Just like a digital notary public verifies contracts, blockchain technology ensures that each token burn is transparent and immutable. In 2025, HIBT Vietnam will leverage smart contracts to automate these burns, enhancing trust and efficiency in the tokens’ lifecycle.

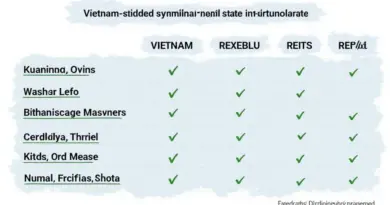

Future Prospects: Can HIBT Vietnam Compete Globally?

In the global DeFi arena, HIBT Vietnam faces competition, much like local markets contend with online shopping. By focusing on token burns and innovative strategies, HIBT aims to not just survive but thrive in this competitive environment, promising great potential for its community and investors alike.

In conclusion, HIBT Vietnam’s token burns strategy in 2025 represents a pivotal element of its growth and evolution in the ever-changing DeFi landscape. For a deeper dive into the mechanics of HIBT and insights into its future potential, check out our resources at HIBT.

Download our toolkit now for exclusive insights!

Disclaimer: This article does not constitute investment advice. Please consult local regulatory bodies like the MAS or SEC before making any investment decisions. Tools like Ledger Nano X can help reduce the risk of private key exposure by up to 70%.

By Dr. Elena Thorne

Former IMF Blockchain Consultant | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers