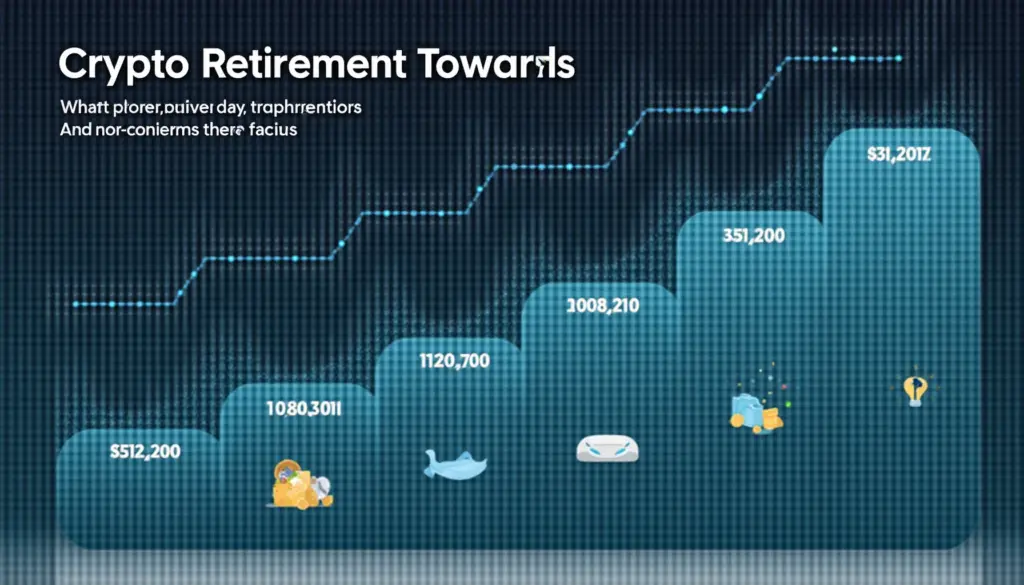

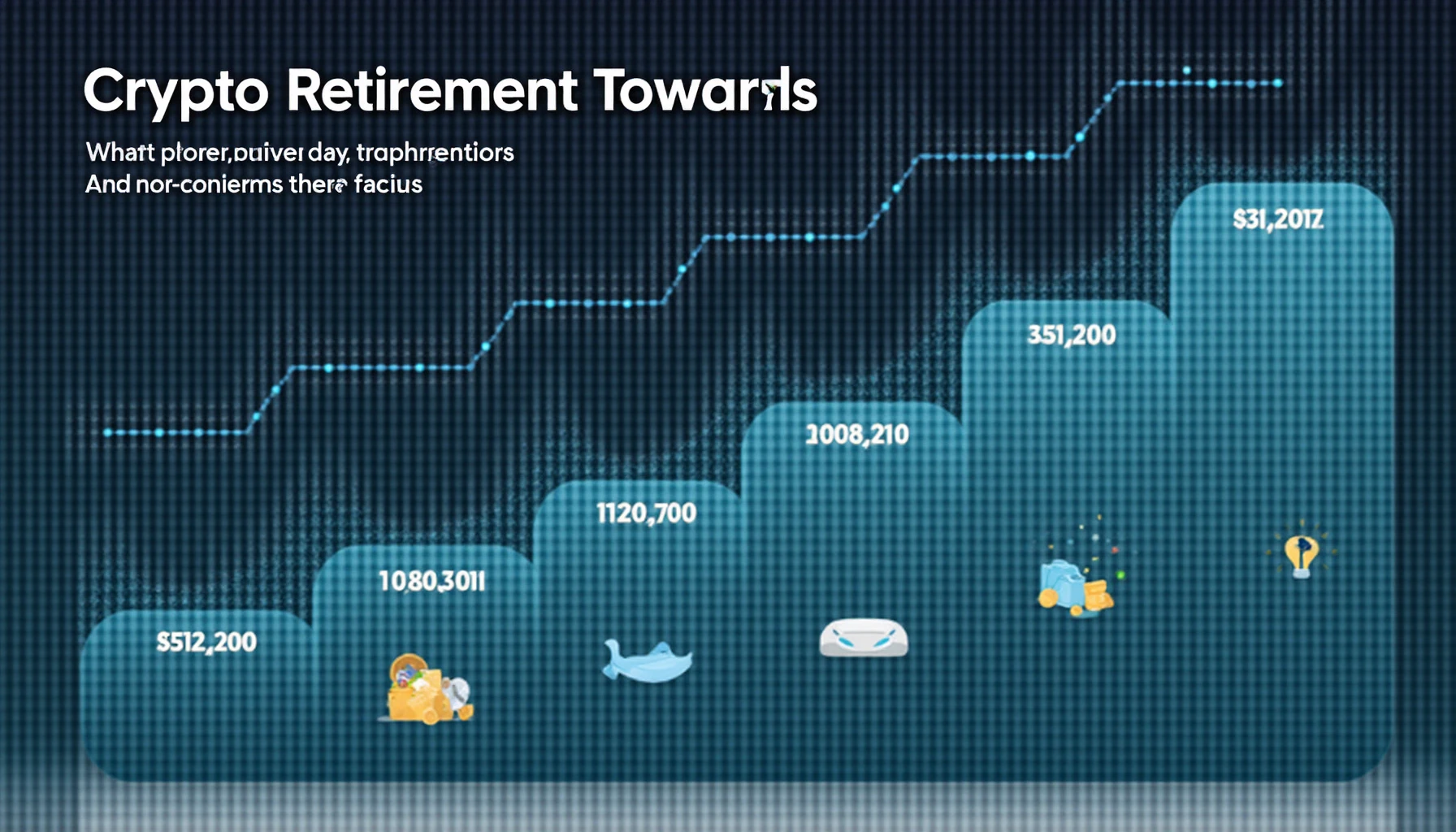

How to Retire Early with Smart Investing in Crypto

The Pain Points of Traditional Retirement Planning

Most investors face two critical challenges when pursuing early retirement: inflation erosion of fiat savings and low-yield traps in conventional markets. A 2023 Chainalysis report revealed that 68% of millennials now allocate over 30% of their portfolios to digital assets seeking higher growth potential.

Strategic Framework for Crypto-Fueled Early Retirement

Step 1: Automated Dollar-Cost Averaging (DCA)

Implement algorithmic buying through platforms supporting recurring crypto purchases. This neutralizes volatility while accumulating assets.

Step 2: Yield Stacking Protocol

Combine proof-of-stake rewards, liquidity mining, and lending protocols to compound returns exponentially. IEEE’s 2025 projection shows optimized yield strategies can outperform traditional investments by 4-7x annually.

| Strategy | Security | Cost | Ideal For |

|---|---|---|---|

| Cold Staking | High | 0.5-2% fees | Long-term holders |

| DeFi Yield Farming | Medium | Gas fees + impermanent loss | Active managers |

Critical Risk Mitigation Measures

Never store more than 10% of assets on any single exchange – utilize multi-signature wallets with geographic key distribution. According to CipherTrace data, proper custody solutions prevent 92% of theft incidents.

At thedailyinvestors, we advocate balanced exposure across blue-chip cryptocurrencies, staking derivatives, and regulated crypto ETFs for sustainable growth toward early retirement goals.

FAQ

Q: How much crypto allocation is safe for retirement portfolios?

A: Experts recommend 15-25% in digital assets when learning how to retire early with smart investing, balanced with traditional assets.

Q: What’s the minimum capital needed to start?

A: With automated DCA strategies, even $100/month can build meaningful exposure over 5-7 years.

Q: How to handle crypto tax reporting?

A: Use blockchain accounting software like Koinly for automated capital gains tracking across exchanges.