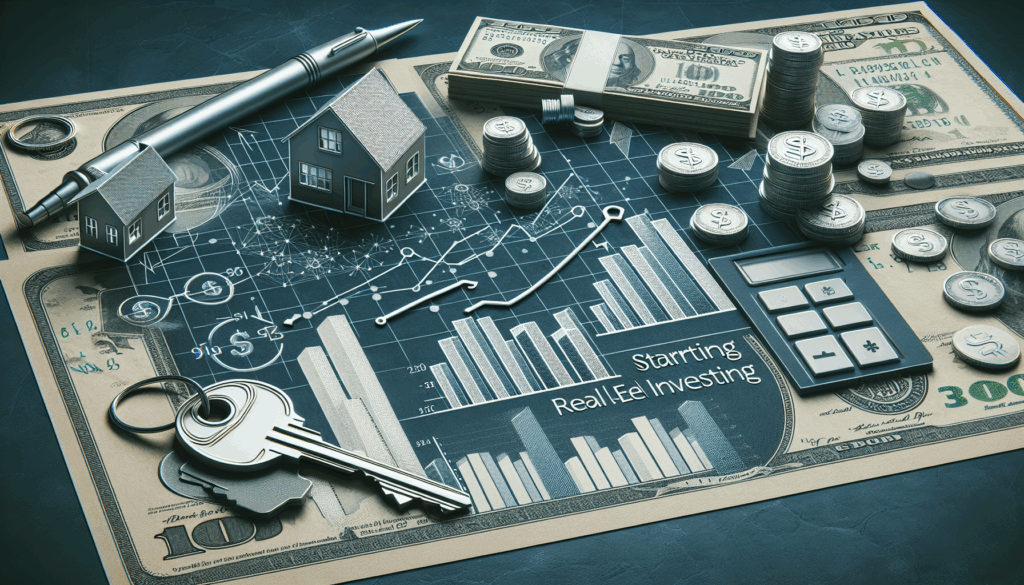

How to Start Real Estate Investing: A Practical Guide

How to Start Real Estate Investing

Pain Points in Real Estate Investing

The journey of real estate investing often begins with excitement but quickly meets with confusion. Many aspiring investors find themselves stumped by the complexities of financing, property management, and market research. For example, consider an individual eager to dive into the real estate market who hesitates due to a lack of knowledge regarding effective investment strategies. This leads to fear of making costly mistakes, causing many to delay their dreams indefinitely. Another common issue is the capital barrier that prevents potential investors from taking the leap towards owning their first property.

Solutions to Kickstart Your Real Estate Investing Journey

To overcome these challenges, it’s crucial to follow a systematic approach. **Knowledge is power**; understanding the various investment methods will enable you to make informed decisions. Here’s a breakdown of effective strategies: Step 1: Research and Analyze the Market – Gather data on prevailing property values and local economic conditions. Utilize online platforms and resources to compare different markets. Step 2: Create a Comprehensive Business Plan – Outline your investment goals, budget, and potential financing options. Step 3: Assess Financing Options – Explore traditional mortgages, private lenders, or even innovative methods like **crowdfunding**.

Comparison Table: Financing Options

| Parameter | Traditional Mortgages | Crowdfunding |

|---|---|---|

| Security | High (requires collateral) | Moderate (depends on project quality) |

| Cost | Low interest rates | Potential fees from platforms |

| Applicable Scenarios | Best for long-term investment | Great for newcomers with small capital |

According to a 2025 report by Chainalysis, the real estate market shows a growing trend towards technological integration, with an increase in crowdfunding by over 40%. Such data underscores the need for investors to stay adaptable to emerging trends.

Risk Warnings for New Investors

Real estate investing has its inherent risks. One primary risk is the **market volatility**, which can lead to unpredictable property values. Another risk involves **liquidity issues**; real estate isn’t a liquid asset, meaning you can’t easily convert it to cash. To mitigate these risks, always perform thorough due diligence and consider leveraging risk management strategies like **insurance** and **diversification**. **Avoid over-leveraging your investments;** instead, prioritize maintaining a balanced portfolio. At The Daily Investors, we emphasize educating our community about potential pitfalls in any investment venture, especially in real estate.

Conclusion

Starting in real estate investing requires a blend of knowledge, careful planning, and calculated risks. By addressing common pain points with structured approaches, you can confidently make your move into the market. For more insights on effectively navigating your investment journey, explore resources found through The Daily Investors.

FAQ

Q: What is the best way to start investing in real estate?

A: The best way to start real estate investing is to conduct thorough market research and create a solid business plan tailored to your financial situation and investment goals.

Q: Is real estate investing risky?

A: Yes, real estate investing carries risks, including market volatility. However, with the right strategies and precautions, these risks can be minimized.

Q: How much capital do I need to start investing in real estate?

A: The required capital to start real estate investing varies based on the investment strategy chosen, but options like crowdfunding allow entry with lower amounts.

Written by John Doe, a seasoned real estate strategist with numerous publications in investment journals and expertise in managing high-profile projects.