Ignore the Shutdown – Watch the Jobs Picture

The government shutdown is just noise… a replay of yesterday’s T-Line event with Keith Kaplan… seasonal hiring is down big… be in tech stocks, or else… one way to invest now

VIEW IN BROWSER

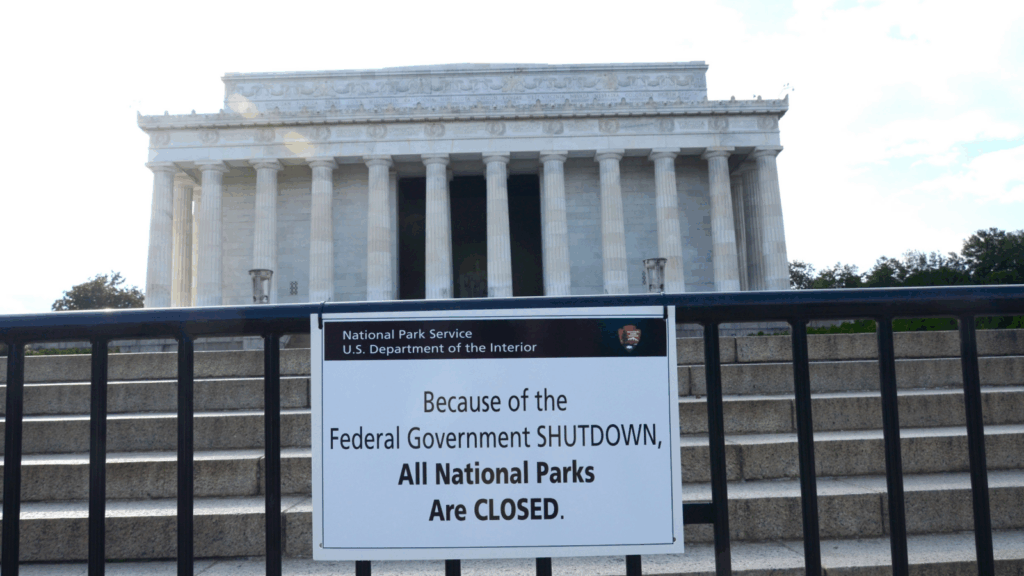

The federal government is officially shut down after lawmakers failed to reach a budget deal yesterday.

Over the next few days, expect the news cycle to be dominated by political brinkmanship. But for Wall Street, these shutdowns are usually just noise.

Here’s our hypergrowth expert Luke Lango with the data:

The U.S. government shutdown that everyone is talking about these days is much-ado-about-nothing for Wall Street.

We’ve had over a dozen shutdowns since 1980 – about one every 3 years. None of them mean squat. They typically last about a week, and stocks barely move during that week.

Nothing to see here.

If this develops into a bigger story that could materially impact your portfolio, we’ll report back. For now, it’s a fleeting sideshow.

Moving on…

Incredible feedback from yesterday’s “T-Line” Event with TradeSmith CEO Keith Kaplan…

Yesterday afternoon, Keith went live to walk attendees through a powerful new tool that helps traders identify when options contracts are mispriced.

This mispricing creates opportunities to step in and collect cash premiums thanks to mathematical odds that are stacked in your favor.

The “T-Line” is named after Ed Thorp – the quant genius who invented card counting and later became one of the most successful hedge fund managers in history. Thorp’s pioneering research into probability and mispricing in options markets laid the groundwork for the T-Line, which Keith and his team have now brought to life.

During yesterday’s event, Keith showed the tool in action. He demonstrated how to spot mispriced trades, and how the T-Line helps sharpen your entry/exit timing while controlling risk.

It builds on TradeSmith’s earlier innovation, the Probability of Profit (PoP) indicator, which has already helped deliver a 98.8% win rate across more than 900 income trades in their model portfolio.

Together, these tools help traders cut through the noise and make more consistent income-generating trades.

Here’s Keith:

In the free replay, you’ll see how the T-Line works and how you can use it to generate your own extra income streams by combining it with the PoP. I also showed some real-world trades you could make right away.

The PoP and T-Line tools could change the way you trade—just as they did for me and thousands of other investors

Bottom line: If you’re looking to pull more cash out of the market, I encourage you to check out the free replay of yesterday’s demonstration.

More red flags from consumer confidence and the labor market

Yesterday, the Conference Board September survey showed that consumers are the least optimistic since April.

From Stephanie Guichard, the organization’s senior economist for global indicators:

Consumers’ assessment of business conditions was much less positive than in recent months, while their appraisal of current job availability fell for the ninth straight month to reach a new multiyear low.

This morning, ADP confirmed the jobs weakness with its latest private payrolls report.

Dow Jones economists had been expecting an increase of 45,000 jobs. Instead, the economy shed 32,000 jobs – the worst performance since March of 2023.

Adding insult to injury, ADP’s August payrolls report, which had come in at 54,000, was revised down to a loss of 3,000 jobs.

This Friday brings the big jobs report that everyone will be watching closely – the Non-Farm Payrolls report from the Bureau of Labor Statistics (assuming there isn’t a wrinkle due to the government shutdown).

August brought just 22,000 new jobs – dramatically below the forecast. The expectation for Friday is a higher-but-still-anemic 43,000 jobs with an unemployment rate that remains at 4.3%.

Meanwhile, seasonal hiring is coming in the weakest in years

If the latest Challenger, Gray & Christmas report is any indication, Friday’s numbers will be disappointing.

Challenger, Gray & Christmas is a leading executive outplacement firm that publishes a variety of jobs market reports. It’s become a go-to resource for getting a bead on labor market conditions.

From its latest report last Thursday, focusing on retail seasonal hiring announcements:

Following a summer of subdued hiring, Challenger, Gray & Christmas expects seasonal Retail hiring in 2025 to fall to its lowest point since the recession-hit season of 2009…

Challenger projects Retailers may add under 500,000 positions in the last three months of 2025, marking the smallest seasonal gain in 16 years.

Here’s Senior Vice President Andy Challenger:

Seasonal employers are facing a confluence of factors this year: tariffs loom, inflationary pressures linger, and many companies continue to rely on automation and permanent staff instead of large waves of seasonal hires?

Automation?

Put a pin in that – we’ll circle back.

A tale of two consumers

In the background of this subdued hiring, since mid-August, we’ve had a string of either “all-time” or “52-week” highs in the investment markets:

- S&P 500 – all-time high

- Nasdaq – all-time high

- Dow Jones – all-time high

- Bitcoin – all-time high

- Gold – all-time high

- Silver – 14-year high

- Uranium (via the ETF URA) – 52-week high

- Copper (via the ETF COPX) – 52-week high

- Chinese stocks (via the ETF MCHI) – 52-week high

- 1-3 Year Treasury bonds (via the ETF SHY) – 52-week high

Americans with assets are riding high, while Americans without assets are facing increasing financial challenges.

This split is tougher to see today because well-off Americans are spending up a storm, skewing the average spending data and camouflaging what’s happening with lower-income Americans.

Here’s Fortune with the reality:

According to Bank of America Institute’s latest report, Consumer Checkpoint: Gains and Gaps, higher-income households are enjoying accelerating wage growth and increased spending, while lower-income households face slowing pay gains and flat expenditure—marking the widest such divide in more than four years…

The result is a warning sign for the economy despite a strong overall spending picture.

Fortune highlights Bank of America Institute senior economist David Tinsley, saying “Lower-income households aren’t really spending.” The well-to-do households are the ones driving the economy.

That’s not anecdotal – in the second quarter of 2025, consumers in the top 10% of the income distribution accounted for 49.2% of all U.S. spending. That’s the highest level since 1989.

But this tale of “haves” versus “have-nots” isn’t limited to the U.S. consumer…

There’s a similar split in the economy and stock market

Let’s return to Luke.

From Monday’s Daily Notes in Innovation Investor:

We’ve told you before that the U.S. economy is bifurcating between a booming AI Economy and a struggling Everything Else Economy. We saw data [Monday] which confirmed this thesis.

Investment in information processing equipment and software rose ~30% in the first half of 2025. Excluding information processing equipment and software investment, real GDP in the U.S. grew just 0.1% in the first half of 2025.

So, essentially, the AI Economy grew by 30% in the first half of the year, while the Everything Else Economy didn’t grow at all.

This won’t change anytime soon.

There’s a similar bifurcation in the stock market with AI stocks crushing just about everything else.

To illustrate, let’s return to Andy Challenger’s reference to “automation” replacing seasonal job work. Let’s expand that to cover robotics and humanoids.

Below, we compare two ETFS:

- The ProShares S&P 500 Ex-Technology ETF (SPXT), which gives us the performance of all “non-tech” stocks in the S&P

- The ARK Autonomous Technology & Robotics ETF (ARKQ), which focuses on tech leaders at the forefront of AI with a tilt toward Physical AI (robotics and humanoids)

As you can see below, over the last 52 weeks, our “AI/robotics” proxy (in black) has soared 86%, 7Xing our “non-tech” proxy (in green) which climbed just 12%.

AI is driving today’s market boom, period.

This is, in part, why Luke has been urging investors to get exposure to automation, robotics, and humanoids.

Clearly, ARKQ is an option. It holds some great stocks, but it also has 37 different holdings. So, some of the performance of ARKQ’s high-fliers – like Tesla, its biggest holding – could be weighed down by underperformers. That’s just a reality of ETF investing.

For a more targeted approach, Luke recently released a free research report that breaks down Tesla’s Optimus humanoid project, flagging a backdoor way to invest in robotics/humanoids without buying Tesla itself.

Bottom line: Today’s bifurcated economy and stock market will only grow more divergent from here. Our best shot at not just surviving this split, but thriving from it, will come from aligning ourselves with AI tech leaders at the forefront of momentum.

Coming full circle

Job growth is falling… asset prices are soaring… and the gap between the “haves” and “have-nots” is widening – whether those “haves” are high-income consumers or leading AI stocks.

This puts even more focus on Friday’s jobs report…

Will the Main Street/AI gap widen?

We’ll report back.

Have a good evening,

Jeff Remsburg

The post Ignore the Shutdown – Watch the Jobs Picture appeared first on InvestorPlace.