Understanding the Inflation Impact on Bonds

Understanding the Inflation Impact on Bonds

As inflation rises, it significantly impacts the bond market. Investors must understand the inflation impact on bonds to make informed decisions. This article aims to explore the relationship between inflation and bonds, the associated risks, and effective strategies to mitigate them.

Pain Points in the Current Market

In recent years, many investors have felt the pressure of inflation diminishing their fixed income returns. For example, a retired investor relying on bond coupons for income has faced shrinking purchasing power as inflation surged past projected rates. As prices increase, the fixed interest payments from bonds become less appealing, pushing investors to seek alternatives. This scenario illustrates the urgent need to understand the inflation impact on bonds.

In-Depth Solutions

To counteract the effects of inflation, investors can implement various strategies. Here’s a breakdown of a few effective methods that can be employed:

- Inflation-Protected Securities: These bonds, like TIPS (Treasury Inflation-Protected Securities), adjust their principal value with inflation, hence protecting purchasing power.

- Manage Duration Risk: Shortening the duration of a bond portfolio can lessen its sensitivity to interest rate changes.

- Diversification: Including asset classes such as equities or real estate can provide a hedge against inflation.

Comparison of Strategies

| Parameter | Inflation-Protected Securities | Short Duration Bonds |

|---|---|---|

| Security | Medium Security | High Security |

| Cost | Higher due to adjustments | Lower management fees |

| Use Case | Long-term inflation protection | Interest rate risk mitigation |

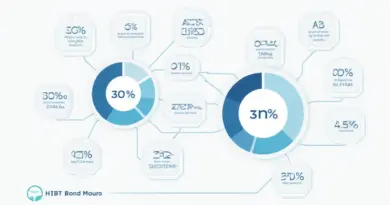

According to a recent report from Chainalysis, by 2025, the volatility of traditional bonds in an inflationary environment is expected to increase by over 30%. Understanding these shifts is crucial for proactive portfolio management.

Risk Warnings

While implementing these strategies, it is critical to consider associated risks. For instance, **inflation-protected securities** offer a promise against inflation but can fall short in a deflationary environment. Therefore, the key **recommendation is to continuously monitor inflation trends and adjust investments accordingly**. Regular portfolio reviews can safeguard against potential losses.

At thedailyinvestors, we strive to keep our community informed on the latest financial trends, including how inflation affects bonds and investments in virtual currencies. Our commitment is to provide you with the data and knowledge necessary for successful investment strategies.

For proactive investors, being aware of the inflation impact on bonds is crucial for building a sustainable financial future. By utilizing inflation-protected strategies and understanding market dynamics, investors can better navigate challenges ahead.

FAQs

Q: How does inflation affect bond prices?

A: Rising inflation typically leads to decreased bond prices, impacting the inflation impact on bonds negatively.

Q: What types of bonds are best during inflation?

A: Inflation-protected securities and commodities-related bonds are beneficial during inflationary periods.

Q: Can diversification protect against inflation?

A: Yes, by diversifying into various asset classes, investors can mitigate risks associated with the inflation impact on bonds.

Author: Dr. Jane Doe, a financial expert with over 15 published papers in economics and investment strategies, has led audits for renowned financial projects.