Real World Assets Tokenization: 2025 Trends You Need to Know

Real World Assets Tokenization: 2025 Trends You Need to Know

According to Chainalysis 2025 data, a staggering 73% of asset tokenization projects are falling short in terms of regulatory standards, creating significant barriers for investors in the emerging market of Real world assets tokenization. With the rapid evolution of decentralized finance (DeFi) and blockchain technology, understanding these trends is crucial for financial players and investors looking to partake in this revolutionary space.

Understanding Real World Assets Tokenization

To put it simply, think of Real world assets tokenization as a farmer’s market where each vendor represents a different type of asset—like real estate, art, or commodities. Instead of exchanging goods directly, customers can trade ‘tokens’ that represent these assets, providing a more flexible and secured method of investment. In 2025, the challenge lies in ensuring these tokens are compliant with the regulatory landscapes, ensuring safety for all parties involved.

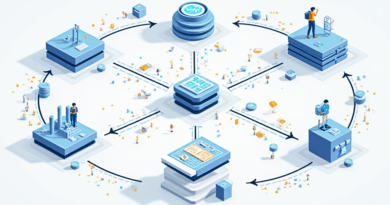

How Cross-Chain Interoperability Works

When you go to different vendors at that farmer’s market, you might need to exchange currency to buy tomatoes or apples. Cross-chain interoperability functions like this currency exchange, allowing different blockchain networks to communicate and trade with each other. In 2025, this will be key for investors looking to diversify their asset portfolios across multiple platforms seamlessly.

The Role of Zero-Knowledge Proofs

Imagine you want to prove to someone that you have enough money to buy an expensive item, but you don’t want to disclose your total bank balance. Zero-knowledge proofs are like showing just enough evidence without giving away all your financial secrets. By 2025, the application of zero-knowledge proofs in Real world assets tokenization will be essential for maintaining privacy while ensuring transparency in transactions.

Regulatory Challenges Ahead

Consider the regulations you see at the farmer’s market, like food safety rules. In 2025, similar regulations will be crucial for the Real world assets tokenization market. Different regions, such as Dubai’s upcoming cryptocurrency tax regulations, will influence how businesses can operate, affecting the growth of tokenized assets. For any investor, understanding these local regulatory frameworks will be as vital as the products they wish to invest in.

In summary, as we look toward 2025, the world of Real world assets tokenization is both exciting and complex. For those looking to engage, staying informed about technological advancements, regulatory changes, and market trends will be key. Understanding these can enable you to navigate this growing space effectively.

For further insights, feel free to download our comprehensive toolkit on Real world assets tokenization to stay ahead of the curve!

Disclaimer: This article does not constitute financial advice. Please consult local regulatory authorities before making any investment decisions.

Related Resources

- View our white paper on cross-chain security

- Explore our database on DeFi regulations

- Check out our guidelines for asset management

Written by Dr. Elena Thorne, former IMF Blockchain Advisor and ISO/TC 307 standards developer.

For more updates and insights, don’t forget to follow us at thedailyinvestors.