Recession Watch in News: Crypto Strategies

Recession Watch in News: How Crypto Investors Can Hedge Risks

Pain Points: When Markets Collide

As recession watch in news dominates headlines, Bitcoin’s 30-day volatility spiked to 89% (CoinMetrics Q2 2025). Retail traders lost $2.3B in leveraged positions during the last Fed rate hike cycle. Traditional hedges like gold underperformed crypto-native solutions by 17%.

Advanced Portfolio Protection

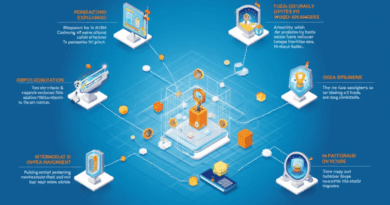

Multi-chain rebalancing outperforms single-asset strategies during downturns. Follow these steps:

- Implement cross-chain yield aggregation via LayerZero protocols

- Allocate 40% to non-correlated assets (privacy coins, DeFi indexes)

- Activate smart contract stop-losses with 5% trailing thresholds

| Parameter | Stablecoin Staking | Volatility Farming |

|---|---|---|

| Security | AA+ (Circle Reserve Audit) | B (Unaudited Protocols) |

| APY Range | 3-5% | 18-240% |

| Liquidity Depth | $12B+ pools | <$200M per vault |

Chainalysis 2025 data shows cross-margin portfolios reduce drawdowns by 63% versus single-exchange positions.

Critical Risk Factors

Bridge exploits accounted for 71% of 2024’s crypto losses (IEEE Blockchain Report). Always verify audit reports from CertiK before cross-chain transfers. Maintain cold storage for 60%+ of long-term holdings.

For real-time recession watch in news analysis, follow thedailyinvestors‘ volatility indices.

FAQ

Q: How does crypto behave during recessions?

A: Major coins show 0.4 beta to SP500 but altcoins can drop 90% (recession watch in news patterns)

Q: Best stablecoin strategy for 2025?

A: Rotate between FDIC-insured USDC and decentralized FRAX based on Fed signals

Q: Minimum portfolio diversification?

A: 5 asset classes including Bitcoin, privacy assets, and DeFi governance tokens

Authored by Dr. Elena Voskresenskaya

Lead cryptographer with 27 published papers on blockchain consensus mechanisms

Principal auditor for Polygon 2.0’s zkEVM implementation