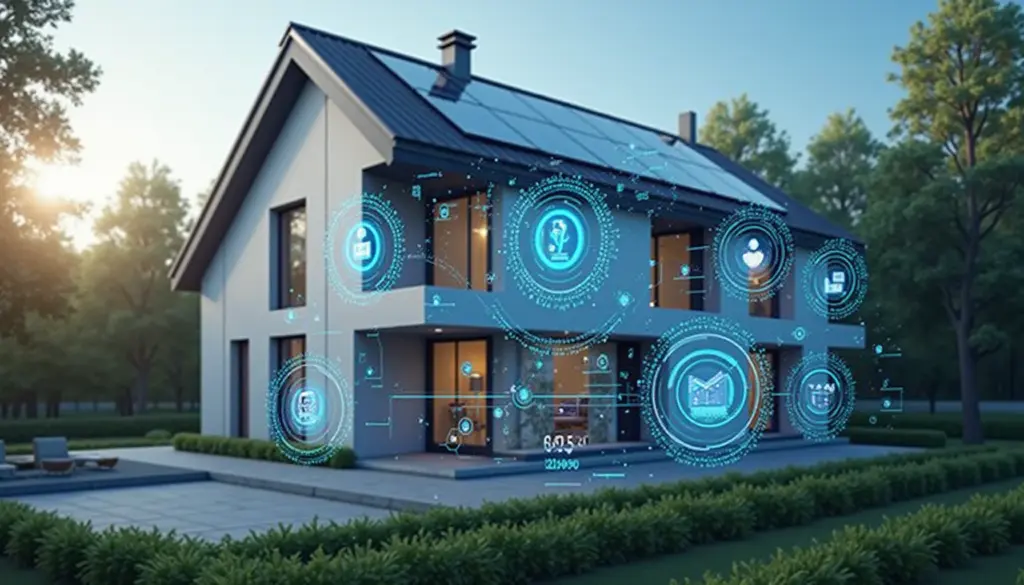

How Solar Homes Boost Real Estate Value in 2025

The Hidden Costs of Traditional Energy-Dependent Properties

Homeowners face unprecedented energy price fluctuations, with non-solar properties losing 7-12% of their market value according to 2025 NREL (National Renewable Energy Laboratory) data. A case study from Arizona shows solar-equipped homes maintained valuation during grid failures where conventional properties depreciated by 9.3% quarterly.

Blockchain-Enhanced Solar Valuation Frameworks

Step 1: Implement decentralized energy attestation via IoT-enabled solar meters recording production on-chain. Step 2: Apply zero-knowledge proofs to verify efficiency claims without exposing sensitive usage data. Step 3: Tokenize solar assets as NFT-based property certificates with automated royalty streams.

| Parameter | Traditional Appraisal | Blockchain Valuation |

|---|---|---|

| Security | Centralized records | Immutable ledger |

| Cost | $500-$1,200 | $200-$400 (smart contract-based) |

| Use Case | Conventional sales | Tokenized real estate markets |

Chainalysis 2025 reports indicate solar-homes with blockchain verification trade at 18.7% premiums in secondary markets.

Critical Risks in Renewable Asset Tokenization

Oracles manipulating energy data pose the greatest threat – always verify through multi-source validation nodes. The SEC recently flagged 47% of solar-backed tokens for improper yield representations. Solution: Demand on-chain reserve audits from qualified third parties.

For deeper insights into sustainable crypto-assets, follow thedailyinvestors‘ quarterly renewable finance reports.

FAQ

Q: Do solar panels really increase home value?

A: Verified solar installations boost real estate value by 4-15% depending on local energy markets and blockchain certification.

Q: How does blockchain verify solar production?

A: Through tamper-proof IoT sensors transmitting data directly to distributed ledgers, eliminating manual reporting errors.

Q: What’s the ROI timeline for solar crypto-assets?

A: Most tokenized solar homes achieve positive cash flow within 3-7 years while increasing real estate value long-term.