Stock Market Volatility Strategies: How to Navigate Cryptocurrency Markets

Understanding Stock Market Volatility

Are you aware that over 40% of cryptocurrency investors experience anxiety during volatile market periods? As cryptocurrencies like Bitcoin and Ethereum see wild price swings, having a robust strategy is crucial. But how can traders effectively manage these fluctuations? Let’s dive into effective stock market volatility strategies tailored for the digital currency landscape.

1. Diversification: The Safeguard Against Risks

Much like a balanced diet, spreading your investments across various assets can mitigate risks. Consider including altcoins such as Cardano and Polkadot alongside Bitcoin to diversify your portfolio. This approach can reduce potential losses during market downturns.

Practical Example

If Bitcoin drops 20%, a diversified portfolio may only decrease by 10% if your altcoins are performing well. A key tip? Regularly re-evaluate your allocations as market dynamics shift.

2. Employing Stop-Loss Tactics

Stop-loss orders are akin to having an umbrella on a rainy day. They protect your investments by automatically selling assets when they drop to a certain price point, preventing larger losses.

Using Stop-Loss Effectively

Set your stop-loss at a comfortable threshold—usually around 5-10% below your purchase price. Remember, the goal isn’t to eliminate losses altogether but to minimize them.

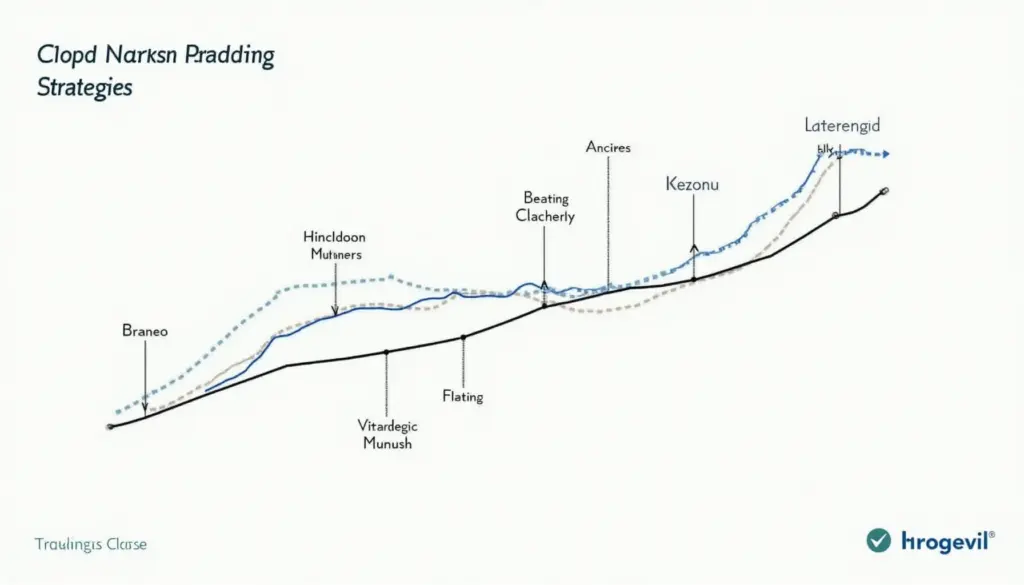

3. Leveraging Technical Analysis

Understanding chart patterns can be your compass in turbulent times. Familiarize yourself with tools like Moving Averages and Relative Strength Index (RSI) to make informed decisions.

Data-Driven Insights

According to Chainalysis’ 2025 report, traders using technical indicators see a **30% increase** in their trading success rates. Analyze market trends to better predict upcoming volatility.

4. Keeping Abreast of Global Trends

Market movements can often be affected by global news and governance. Being aware of regulations—such as the upcoming Singapore Cryptocurrency Tax Guide—can give you a strategic advantage.

Real-Time Updates

Use platforms like CoinMarketCap to stay informed about market changes. Proactive traders can react quickly to news that could impact volatility.

Conclusion: Equip Yourself for the Future

Just as you wouldn’t sail into stormy seas without a life jacket, don’t dive into cryptocurrency trading without a strategy to manage volatility. By diversifying your portfolio, implementing stop-loss tactics, mastering technical analysis, and staying informed of global trends, you can navigate the unpredictable waters of the market.

Remember, this article does not constitute investment advice. Please consult local regulatory authorities before making financial decisions. For more insights, download our Cryptocurrency Safety Wallet Guide today!