Stop Loss Strategy Explained: Navigating Cryptocurrency Trading Risks

Understanding the Basics of Stop Loss Strategy

Have you ever wondered how traders confidently navigate the volatile waters of cryptocurrency trading? With over 5.6 billion cryptocurrency owners globally, proper risk management is key. A stop loss strategy can save your investments from drastic downtrends.

What is a Stop Loss Strategy?

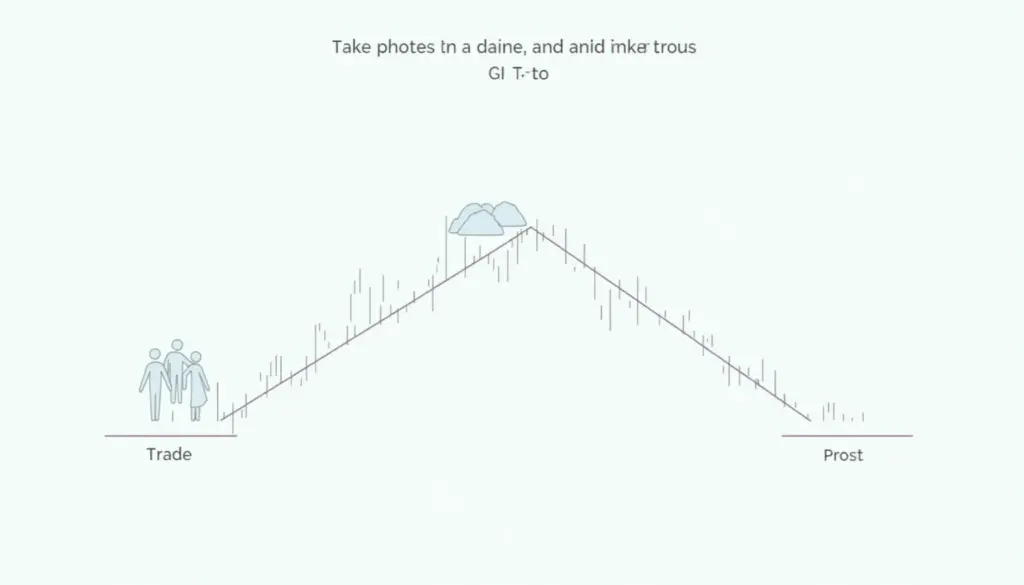

A stop loss strategy is a predefined price point at which an investor sells an asset to limit their losses. Think of it as a safety net. For instance, if you buy Bitcoin at $30,000 and set a stop loss at $28,000, your exchanges will automatically sell if the price drops to this threshold. This helps prevent larger losses during market downturns.

Why is it Crucial for Digital Currency Trading?

The cryptocurrency market is notably volatile. According to CoinDesk, Bitcoin and other altcoins can swing dramatically within hours. Here’s why a stop loss is essential:

- Protects your capital from sudden drops

- Reduces emotional trading decisions

- Optimizes your trading strategies by locking in profits at specific price points

How to Set Up a Stop Loss: A Step-by-Step Guide

If you’re looking to implement a stop loss strategy, here’s a simple process:

- Determine your risk tolerance: Decide how much loss you can handle.

- Analyze the market trends: Use services like CoinMarketCap or LiveCoinWatch to track price movements.

- Set your stop loss percentage based on market data, ideally in the range of 5-15% below your purchase price.

- Execute your trade, ensuring your stop loss is activated in your trading interface.

Common Mistakes to Avoid with Stop Loss Strategies

Trading isn’t easy, and the stop loss strategy is no exception. Here are some pitfalls to avoid:

- Setting the stop loss too tight: This can lead to unnecessary losses from market fluctuations.

- Ignoring market conditions: Always evaluate if a downturn is part of a larger trend.

- Not adjusting your stop loss: As you gain profits, adjust your stop loss to secure your investment.

Conclusion: Enhance Your Trading Strategy with Stop Loss

A stop loss strategy is not merely a reactive measure but a proactive step in managing your digital currency investments. Whether you’re buying the potential altcoins of 2025 or navigating local regulations like Singapore cryptocurrency tax guidelines, implementing a stop loss can make a significant difference.

Consult with local authorities before trading and consider professional advice. Ready to start optimizing your cryptocurrency investments? Download our comprehensive guide on cryptocurrency trading strategies.