The $25 Trillion Monster Hiding Inside Tesla Stock

Something extraordinary just happened in Hollywood … and no, it wasn’t a movie premiere. It was the future… serving popcorn.

At Tesla’s (TSLA) new retro-futuristic diner on Santa Monica Boulevard, a humanoid robot walked straight out of science fiction and into a real-world job.

Its name? Optimus. And it wasn’t sealed behind glass or confined to a lab. It was up and moving – delivering snacks to human customers like it was the most ordinary thing in the world.

Except it’s not ordinary. It’s historic. A milestone. The first visible spark of a trillion-dollar fire.

Because Tesla’s humanoid robot has now officially entered the real world.

“This will be the biggest product ever.”

That’s what Elon Musk said during Tesla’s Q2 2025 earnings call last week – just days after Optimus began serving popcorn at the Tesla Diner. He called the next-gen Optimus 3 “an exquisite design” with “no significant flaws,” and confirmed scale production is on track for early 2026.

“We’re going to try to scale Optimus production as fast as it’s seemingly possible to do,” Musk said. “A reasonable aspiration is one million units a year within five years.”

Let that sink in: one million humanoid robots per year – by 2030.

Sound crazy? Remember: Optimus bots are already working inside Tesla factories. Now, they’re stepping into public-facing roles.

At the diner, one Optimus unit is serving real customers.

At Tesla’s Palo Alto office, “Optimus is walking around the office 24/7, like it’s normal,” Musk said. “We’ll go from a world where robots are rare to where they’re so common you don’t even look up.”

We’ve crossed the threshold.

The age of humanoid robots isn’t coming.

It’s here.

How Big Could Tesla Stock Get? Let’s Do the Math

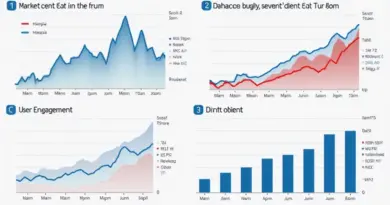

Tesla is targeting a $25,000 price point for its humanoid robot – less than the cost of most new cars.

Now imagine this: What if 50% of U.S. households eventually own one?

There are approximately 130 million households in America. If half of them adopt Optimus, that’s:

65 million units × $25,000 = $1.625 trillion in revenue.

That would make Optimus the largest consumer hardware business in history – surpassing even the iPhone.

And speaking of iPhones…

Today, there are an estimated 1.2 billion active iPhones worldwide. What if humanoid robots follow a similar adoption curve?

Let’s stay conservative. Assume that by 2040, 1 billion Optimus units are in use globally.

The math:

1 billion units × $25,000 = $25 trillion in hardware revenue.

And that’s just the beginning.

Now add recurring revenue streams: software subscriptions, app store equivalents, upgrades, maintenance, training services, cloud-based AI coordination.

This isn’t just a hardware revolution. It’s a full-scale platform shift – one that could redefine the global economy.

And Tesla isn’t catching up…

It’s leading.

Tesla Stock: From Car Company to Physical AI Superpower

Elon Musk didn’t downplay the moment.

“Optimus will ultimately be more valuable than everything else Tesla does combined,” he said on the company’s Q2 earnings call. “Provided we execute very well, I think Tesla has a shot at being the most valuable company in the world.”

This isn’t just hype.

Tesla has spent years advancing real-world AI through its Full Self-Driving (FSD) platform. It’s already using Optimus robots in its own factories. It’s building the hardware in-house – motors, sensors, neural networks – designed from first principles. And now, it’s putting robots in front of real customers.

Musk says the Optimus 3 is “the right design.” Not a concept. A commercial product. The company is targeting 100,000 units per month within five years.

That’s not an AI prototype in a lab.

That’s scale.

Investors: This Is the Ground Floor

We’ve now seen the first real-world deployment of Optimus.

We’ve heard Elon Musk lay out a clear roadmap for mass production.

We’ve run the numbers … and even modest adoption points to trillions in potential revenue.

And yet, Wall Street still hasn’t fully woken up.

Yes, Tesla shares have moved. But the market continues to treat Optimus like a speculative sideshow.

That is a profound miscalculation.

This is Apple in 2006, before the iPhone. Amazon in 1999, before Prime.

It’s a moment of asymmetry … between what’s already happening and how little investors have priced it in.

The real-world rollout has begun.

The technology is maturing. The cost is accessible. The total addressable market (TAM) is almost limitless.

Humanoid robots will be the next great platform shift.

Tesla is leading the charge.

And the time to act is now.

So, where does this all lead?

Straight into what renowned futurist Eric Fry calls the “Age of Chaos” – a high-stakes period where seismic shifts in tech, geopolitics, and the economy could make (or break) fortunes.

Fry isn’t new to this game. He’s recommended more than 40 stocks that soared over 1,000%, successfully navigating both bull and bear markets.

Now he’s back with what may be his most urgent call of the decade.

Eric just released his “Sell This, Buy That” blueprint for navigating today’s AI-fueled mania. Inside, he names seven tickers – four he says to ditch immediately… and three high-conviction buys he believes could be life-changing in the months and years ahead, including:

- A little-known robotics firm whose revenue has soared 15x since 2019 … and one he believes could outmaneuver Tesla in the physical AI arms race

- An under-the-radar online retailer Fry says could become the next Amazon – with 700% upside potential

- A safer AI alternative to Nvidia (NVDA) – a defensive play he believes can protect capital while capturing significant upside

He’s giving away the tickers, along with all the research behind them.

Click here to access Eric Fry’s seven “Sell This, Buy That” trades for the Age of Chaos.

The AI boom is real. Corporate earnings are surging. But not all tech stocks will survive the next phase. Fry believes the next 12 to 24 months could be the most volatile of our lifetimes … and this may be the best window you’ll get to position yourself before the new economic order takes hold.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site. Questions or comments about this issue? Drop us a line at langofeedback@investorplace.com.

The post The $25 Trillion Monster Hiding Inside Tesla Stock appeared first on InvestorPlace.