This Simple “Divergence” Pattern Made 100% in 19 Days

Editor’s Note: The markets today are more chaotic than ever – driven by tariff announcements, inflation shocks and global political shifts. But I like to say that volatility creates opportunity for those who know where to look.

My colleague Jonathan Rose, a professional trader for the past 27 years, has built his career doing just that. During the 2008 crash, while most investors panicked, he made over $4 million using a strategy few retail investors even know exists: Divergence trading.

He just spotted what he calls the “Trade of the Decade” – a rare divergence unfolding between gold and silver. I believe it could be one of the most potentially lucrative setups we’ve seen in years.

In the article below, Jonathan breaks down how these trades work including one he recently closed for a 100% gain in just 19 days. If you’re looking for a smarter way to profit from today’s volatility, this is a must-read.

And if you want to learn how his strategy works, and why it thrives in markets like today, I highly encourage you to watch Jonathan’s new presentation.

I’ll let Jonathan take it from here…

**********************

Talk about a sweet setup…

Back in April, I spotted the chance to double my subscribers’ money in a matter of weeks with one of my signature trades.

This was in the wake of President Trump’s “Liberation Day” tariff announcements.

Markets were in chaos. Volatility was spiking. And the TV news anchors and armchair analysts on social media were in full-on doomsday mode.

But I wasn’t paying attention to the headlines or to the latest rant on X. Here’s what caught my attention instead…

The tariff-war panic wasn’t just hitting random stocks. It was creating massive divergences between entire stock markets that usually move in sync.

I’ve been a professional trader for the past 27 years. I’ve seen just about every kind of market you can imagine – the good, the bad, and the truly chaotic.

And I’ve learned that when markets that usually move together suddenly break apart, you can make a lot of money betting on them coming back into line again.

That’s exactly what happened in April.

I bet on one of these divergences coming back into line again – and closed that trade 19 days later for a 100% gain.

And it’s not the only “divergence trade” that’s led to triple-digit winners. I’ve used the same strategy to close out gains of…

- 122% in 35 days

- 127% in 5 days

- 142% in 39 days

- 322% in 32 days

- 411% in 39 days

- 752% in 40 days

- 805% in 70 days

- And 967% in 52 days

Now, a new major divergence is forming. And I’m sharing all the details in a new on-camera presentation.

I hope you’ll hear what I have to say. Because it has the potential to deliver thousands of dollars in profits without you taking crazy risks with your money.

Just ask one of my followers, Dan B…

The last time this same divergence happened he took a single position and walked away with a game-changing result. As he later wrote me…

My account went from $44,325 to over $180,000 – on a single trade.

So today, I’ll show you how divergence trades work… including the recent one that netted a 100% gain.

First, let’s make sure you understand what a divergence is – and why it’s such a powerful trade signal to follow.

Forget Binary Bets – It’s All About Relationships

Picture a presidential motorcade.

Lights flashing. Helmets of the motorcycle outriders gleaming in the sun. Blacked-out SUVs rolling along in sync.

Same speed, same spacing, same mission.

Everything is as you’d expect.

But then… one of the SUVs breaks formation and suddenly surges ahead.

You know that can’t last. Sooner or later, it has to fall back in line.

And sure enough, after a moment out front, the outlier SUV drifts back into formation.

That’s exactly how I see the market.

I don’t make binary bets on whether a stock will go up or down like most rookie traders do.

Instead, I look for relationships between stocks that usually move together – but occasionally break apart. When that happens, I place trades that payoff when those relationships come back into line.

This reframe – from guessing direction to tracking relationships – has been the foundation my success since I got my start as a trader on the floor of the Chicago Mercantile Exchange in 1997.

In fact, one of my first big wins came when I spotted something unusual during the Nasdaq’s digital transformation…

…a regular divergence between prices quoted on the trading floor and those quoted on the new electronic system.

That pattern launched my career.

And trading divergences like this has helped me make a lot of money as a trader over the years.

I’m talking more than $800,000 in 2006… $2.3 million in 2007… and $4 million in 2008 – during the worst meltdown for stocks since the Great Depression.

It’s not about trying to predict the future….

Staring at candlestick charts or memorizing Fibonacci patterns…

Or chasing the latest “hot stock” making headlines.

All you need to do is spot when two related assets get pulled too far apart… and position yourself to profit when they come back together.

Let me help you see what I mean with some examples.

It Doesn’t Take a Genius to Spot These Divergences

This first chart is of two e-commerce giants – Amazon.com (AMZN) and Alibaba (BABA).

Normally, these two stocks move in line. But sometimes they diverge (red circles). Then those divergences come back in line again (green crosses).

Here’s another classic pair of stocks that typically trades in line but sometimes diverges – rideshare rivals Uber (UBER) and Lyft (LYFT).

And here are gunmakers Smith & Wesson Brands (SWBI) and Sturm, Ruger, and Company (RGR).

That’s really all there is to it. Spot when the two lines are breaking apart and bet on them coming together again.

That’s what I did for the trade I mentioned up top.

Remember I said that the trade war was causing entire stock markets to diverge?

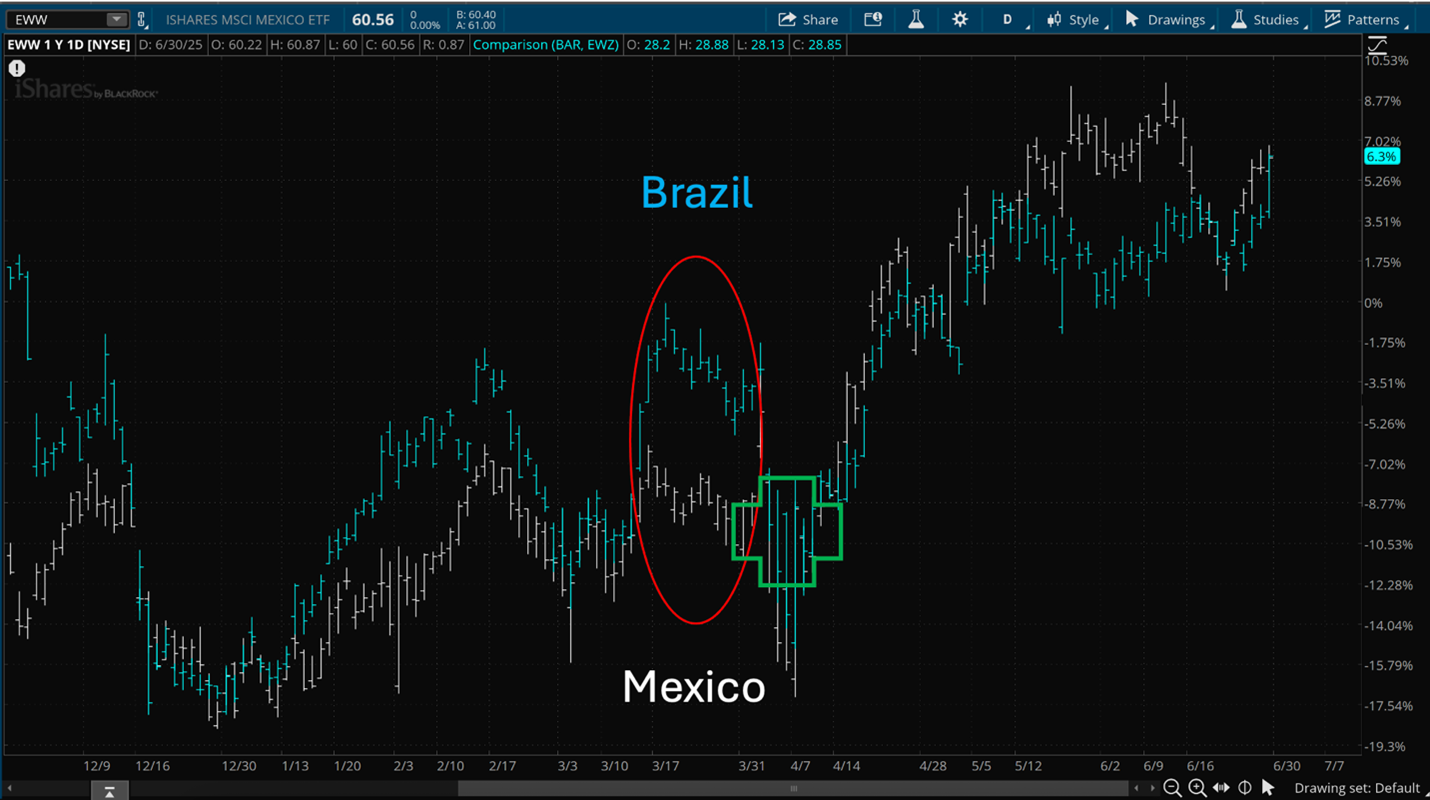

The two stock markets I zeroed in on were Brazil and Mexico.

They’re Latin America’s two biggest economies. Normally their stock markets move in line with one another.

But Mexico is far more economically tied to the U.S. through manufacturing and exports – particularly autos – than Brazil.

So, when President Trump ramped up his trade war rhetoric and floated the idea of a 25% auto tariff, the Mexican stock market got hit hard.

Brazil is more of a commodities play with looser U.S. trade links. And it escaped the drubbing.

So, the iShares MSCI Mexico ETF (EWW) and the iShares MSCI Brazil ETF (EWZ) began to diverge – with Mexico suddenly looking cheap relative to Brazil.

Take a look…

That trade was simple: Place a bullish trade on the Mexican ETF and a bearish trade on the Brazil ETF.

The result – a 100% gain in just over two weeks.

With results like that, you may think it’s the wins I’m most proud of.

But what really motivates me is helping my community of apprentice traders learn to trade like the pros.

More Than Just Trades – It’s a Community

At my Masters in Trading advisory, I’ve trained more than 100 professional traders and more than 30,000 subscribers.

My subscribers are from all walks of life – retired airline pilots, pediatricians, building contractors, TV and film actors, you name it.

And their feedback is hugely encouraging. Like this note from community member Carmine S…

Jonathan, thank you for all your knowledge and for your students who are sharing. I have more 100%-ers in the past several weeks compared to the last several years. You all are leaps abounds above anyone else out there.

Or this from community member Nancy R…

After I retired, I was kind of bored and looking to be intellectually stimulated. Masters in Trading was the fifth group I joined. The best thing that’s happened since I’ve joined is that now I’m making money instead of losing money and understanding my trades better…

One of the things that makes me the happiest is connecting with people. I’m a pretty social, gregarious kind of person, but I don’t want to spend my whole life going out to lunch with my friends. The community at Masters in Trading is small and you get to know people. We’re all really one big family.

Or this incredibly touching note from community member Brian…

Last year was one of the hardest and best years for my family. My wife nearly died while carrying the last addition to our family, going into vtac at 8 months. The hospital bill for my wife was $250k and the bill for the beautiful baby girl she gave birth to was $500k.

I would write down all the lessons I’ve learned from JR but honestly they are too numerous… I had bought and sold some stocks with some success, but that is the extent of my trading experience. I allocated $200k for trading via JR’s method and he doubled that in less than a year. JR you’re a legend buddy.

I wish I had time to tell you more about my trading education program… and how to spot divergence setups.

But I’ve gone on too long already.

So, if you want to see how these trades work – and why a massive new divergence is setting up right now – watch my presentation here.

I’ll get into a ton more detail about how you can use these trades to speed up your wealth building journey… and avoid the wealth destroying mistakes so many rookie traders make.

And remember, the creative trader always wins!

Jonathan Rose

Founder, Masters in Trading

P.S. I hope you’ll check out my new divergence trading presentation. It distills my nearly 30 years of experience as a professional trader into one short video.

You can also catch me on my daily livestreams at 11 am ET every day the markets open at my Masters in Trading LIVE YouTube channel.

On these livestreams, you’ll get…

- A professional trader’s morning check-in

- Insights into what sectors are moving the market

- And real-time setups you can follow in your account

This livestream video I recorded on Tuesday is all about divergence trading.

The post This Simple “Divergence” Pattern Made 100% in 19 Days appeared first on InvestorPlace.