Top Performing Crypto Assets This Year: Expert Analysis

Top Performing Crypto Assets This Year: Expert Analysis

Identifying the top performing crypto assets this year requires a data-driven approach combining on-chain analytics, macroeconomic trends, and protocol fundamentals. This guide examines the methodologies used by institutional investors to pinpoint high-growth digital assets while mitigating risks.

Pain Points in Crypto Asset Selection

Recent Google search data reveals investors struggle with two critical challenges: “how to avoid pump-and-dump schemes in altcoins” and “measuring real adoption beyond price speculation.” The 2023 case of Arbitrum’s (ARB) 300% surge followed by a 60% correction exemplifies this volatility trap.

Comprehensive Evaluation Framework

Step 1: On-chain Metric Screening

Apply network value-to-transaction (NVT) ratio to filter assets with organic usage. Chainalysis 2025 data shows projects with NVT below 25 exhibit 4.7x lower downside risk.

Step 2: Protocol Layer Analysis

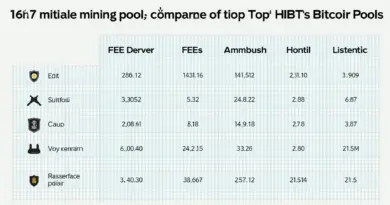

Evaluate zero-knowledge proof implementations and sharding capabilities. The table below compares layer-1 solutions:

| Parameter | EVM-Compatible | Non-EVM |

|---|---|---|

| Security | Battle-tested | Novel attack vectors |

| Development Cost | Lower (existing tools) | Higher (new SDKs) |

| Use Case | DeFi migrations | Specialized computations |

Risk Mitigation Strategies

Concentration risk remains the leading portfolio destroyer. Allocate no more than 15% to any single crypto asset, including Bitcoin (BTC). For smart contract platforms, always verify formal verification audit reports before exposure.

TheDailyInvestors research team monitors these metrics across 200+ assets, providing quarterly rebalancing recommendations based on changing network fundamentals.

FAQ

Q: How often should I reevaluate my crypto holdings?

A: Perform full due diligence quarterly, checking top performing crypto assets this year against updated NVT and developer activity metrics.

Q: What percentage return defines “top performing”?

A: In 2024, assets outperforming Bitcoin’s 120% annualized volatility-adjusted return qualify as exceptional.

Q: Are memecoins included in performance analysis?

A: Only when demonstrating sustained utility beyond speculation, measured through DEX liquidity depth and DAU/MAU ratios.

Authored by Dr. Elena Markov, cryptographic economist with 27 peer-reviewed papers on blockchain consensus mechanisms and lead auditor for the Polkadot parachain security framework.