Trump Calls for a Fed Mutiny

The jobs report shows a weakening labor market… Waller appears vindicated… will Powell “walk the plank”?… a September rate cut looks likely… Jonathan Rose’s subscribers are cashing in… Apple/Amazon earnings

VIEW IN BROWSER

What a freaking mess.

That’s legendary investor Louis Navellier’s short takeaway from this morning’s jobs data.

The July employment report showed a significant softening in hiring, with nonfarm payrolls coming in at 73,000 jobs, below the estimate of 100,000 – which was already a relatively low bar.

Meanwhile, the unemployment rate ticked up to 4.2% from 4.1%, which was in line with expectations.

While these numbers point toward growing weakness in the labor market, what’s rattling everyone is the jaw-dropping size of the downward revisions from prior months.

June and May numbers were slashed. Together, the revisions meant the U.S. economy created 258,000 fewer jobs than the previously announced levels.

This morning, Louis pulled no punches in his Growth Investor Flash Alert:

What a freaking mess.

So, what Christopher Waller – one of the Fed governors who dissented on Wednesday – what he said is right: There are problems in the labor market. He sensed that; he was reading the data.

And of course, the Fed doesn’t follow that data. That is what’s so frustrating.

Backing up to fill in a few details…

Waller and fellow Fed Governor Michelle Bowman were the two dissenters at Wednesday’s FOMC meeting. They wanted to cut interest rates but were outvoted.

Behind the dissent is concern over growing weakness in the jobs market. Here’s Waller describing this in a recent speech:

While the labor market looks fine on the surface, once we account for expected data revisions, private-sector payroll growth is near stall speed, and other data suggest that the downside risks to the labor market have increased.

With inflation near target and the upside risks to inflation limited, we should not wait until the labor market deteriorates before we cut the policy rate.

But what about inflation? Might Waller’s proposed interest rate cuts result in an inflationary resurgence?

This morning, the Fed released the following statement from Waller explaining why he dissented on Wednesday. I’ll zero in on his response to inflation concerns:

Tariffs are one-off increases in the price level and do not cause inflation beyond a temporary increase.

Standard central banking practice is to “look through” such price-level effects as long as inflation expectations are anchored, which they are…

I fully respect the views of my colleagues on the FOMC that suggest we need to take a “wait and see” approach regarding tariffs’ effects on inflation…but I believe that the wait and see approach is overly cautious, and, in my opinion, does not properly balance the risks to the outlook and could lead to policy falling behind the curve.

The price effects from tariffs have been small so far, and since we will likely not get clarity on tariff levels or their ultimate impact on the economy over the course of the next several months, it is possible that the labor market falters before that clarity is obtained—if it ever is obtained.

When labor markets turn, they often turn fast.

An overnight, downward revision of 258,000 jobs qualifies as “fast.”

Meanwhile, Powell – while willing to speak to the risk of labor market weakness – has been fixated on what Louis has called the “boogeyman” of runaway inflation that hasn’t materialized.

For example, during Powell’s press conference on Wednesday, he paid lip service to Waller’s suggestion to “look through” this one-time inflation, saying:

A reasonable base case is that the effects on inflation could be short-lived, reflecting a one-time shift in the price level.

But then he immediately showed his hand – his subsequent comments revealing his greater concern for lingering inflation:

It is also possible that the inflationary effects could instead be more persistent, and that is a risk to be assessed and managed.

Our obligation is to keep longer-term inflation expectations well-anchored, and to prevent a one-time increase in the price level from becoming an ongoing inflation problem.

Perhaps inflation will spike and vindicate Powell – after all, as we learned this week, PCE inflation is inching higher.

But for the moment, with the labor market appearing to be under greater pressure than price increases, the odds are rising that Powell’s “wait and see” approach could go down as another incorrect policy decision alongside “transitory inflation.”

So, what happens now?

First, there’s the political fallout.

President Trump is calling for a Fed mutiny, asking FOMC members to “assume control” of the Fed if Powell doesn’t cut rates.

From Trump on Truth Social:

Jerome ‘Too Late’ Powell, a stubborn MORON, must substantially lower interest rates, NOW. IF HE CONTINUES TO REFUSE, THE BOARD SHOULD ASSUME CONTROL, AND DO WHAT EVERYONE KNOWS HAS TO BE DONE!

Here’s Louis’s take:

President Trump is calling for a mutiny on the Federal Open Market Committee.

I don’t know how they make Jerome Powell walk the plank, but that’s what President Trump is calling for.

While there won’t be any plank walking forced by the FOMC members, we will most likely get a September rate cut now.

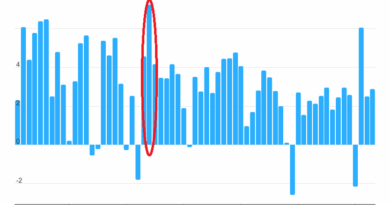

We can see this in the CME Group’s FedWatch Tool, which shows us the probabilities that traders are assigning to various fed funds target rates at different future dates.

Yesterday, traders only put 37.7% odds on a rate cut in September. Today, the probability has exploded to 80.8%.

Overall, here’s Louis’ bottom line on this morning’s drama:

It’s just unfortunate that the rest of the FOMC did not see what Governors Waller and Bowman saw.

Hopefully, the FOMC is going to do the right thing because this payroll report today was a disaster.

And whatever is going on in the Labor Department with seasonal adjustments – somebody should stick their tail between their legs and leave. It’s just not reliable anymore.

As we’re going to press, Louis has gotten his wish…

From CNBC:

President Donald Trump on Friday fired the Bureau of Labor Statistics commissioner, hours after the agency reported that job growth in the U.S. had slowed to a near-halt…

“Important numbers like this must be fair and accurate, they can’t be manipulated for political purposes,” the president wrote.

“[Dr. Erika McEntarfer, the Commissioner of Labor Statistics] said there were only 73,000 Jobs added (a shock!) but, more importantly, that a major mistake was made by them, 258,000 Jobs downward, in the prior two months. Similar things happened in the first part of the year, always to the negative.”

We’ll keep you updated as this story develops.

Turning to the market, it’s selling off as you’d expect – and Jonathan Rose’s subscribers are quite happy with the result

First, an official “welcome” to all the Jonathan Rose subscribers who just joined our Digest readership file.

You already know the caliber of insight Jonathan brings, but as a Digest reader, you’ll now access three additional world-class analysts: Louis Navellier, Eric Fry, and Luke Lango.

My role is to bring you highlights of their research and related action steps – every day the market is open – while keeping you updated on the latest headlines impacting your portfolio. You’ll also hear from our Chief Content Officer Luis Hernandez on Saturdays, and senior analyst Tom Yeung on Sundays.

So, welcome! We’re excited to have you with us.

Returning to today’s market action, all three indexes are down more than 1% as I write. But while this is bruising the average buy-and-hold portfolio, Jonathan’s subscribers are cashing in.

For context, let’s rewind to Tuesday’s Digest:

Veteran trader Jonathan Rose is betting on one (or both) of the following two scenarios playing out over the next two weeks:

- Tech stocks fall

- Volatility jumps

In short, Jonathan recognized that the options market was incorrectly pricing the risk of a jump in volatility.

So, he recommended his subscribers enter a defined-risk put spread on QQQ [the Nasdaq ETF], targeting a move lower into August. He had made a similar bet on the Qs last week (though with a different spread).

Here was his rationale for both trades:

If even one domino falls—whether it’s a hawkish Powell, a hot jobs report, or disappointing guidance from Apple or Amazon—the VIX could spike and pressure the broader market.

And that brings us to this morning’s fireworks.

Here’s Jonathan’s trade alert to his Divergence Trader subscribers:

The VIX is spiking and the QQQs are now down 2%, let’s take profits while this trade is hot.

Two fantastic trades! Get on prints!

Jonathan’s subscribers are walking away today with respective gains of 115.6% in four days and 265.2% in 11 days.

A huge “congratulations!”

And again, to all our new Jonathan readers, welcome to the Digest.

To get a better sense for Jonathan and his trading, join him for his free Masters in Trading Live broadcasts at 11:00 a.m. Eastern time every day the market is open. They’re a fantastic way to learn more about trading and the strategies Jonathan uses to pull triple digit winners out of the market in just days.

Checking in on Amazon and Apple Q2 earnings

Amazon and Apple reported earnings yesterday after the bell – and both stocks are getting dinged as I write Friday.

Amazon reported good numbers overall. It beat on both revenue and earnings per share.

But Wall Street didn’t like how Amazon Web Services (AWS) growth rate lagged Microsoft Azure and Google Cloud’s recent reported growth. This is raising some investor concerns about the ongoing AI infrastructure race.

Also, Amazon’s Q3 operating income guidance fell short of analyst expectations.

As I write, the stock is down about 7%.

Turning to Apple, it also beat on both revenues and earnings. In fact, its earnings per share came in at $1.57, well above the anticipated $1.43, and its revenue growth clocked in as the largest quarterly increase since December 2021.

The downside is that tariffs added $800 million to costs in Q2, and Apple expects this to increase to $1.1 billion in Q3 if the situation doesn’t change.

So, investors are taking profits, sending Apple down about 2% as I write.

Wrapping up, what can we say other than “Welcome to August!”

Overall, it’s a pretty bad start to what, historically, is a pretty bad month.

No wonder Louis says, “They should just close the stock market in August and reopen in September.” But hang on, because it’s just getting started.

On that note, we’ll give Louis the final word:

It’s August, so it’s going to get bumpy. So, we need to hang on for dear life…

I would highly advise you not to look at the market daily because you’ll get sick.

Have a good evening,

Jeff Remsburg

The post Trump Calls for a Fed Mutiny appeared first on InvestorPlace.