Trump’s New Tariffs: The Bull Market’s Next Big Test

Trump ratchets up trade pressure… a new August 1 deadline… are trade deals coming within 48 hours?… how to trade the market at record highs… what Louis Navellier is buying today

VIEW IN BROWSER

Over the July 4th weekend, President Trump signed letters for 12 unspecified countries, detailing the tariffs they’ll face – and they’re beginning to hit inboxes today.

As I write just after market close, we have the details of seven such letters:

From CNBC:

At least seven countries’ imports are set to face steep blanket tariffs starting Aug. 1, President Donald Trump revealed Monday.

The president, in a series of social media posts, shared screenshots of form letters dictating new tariff rates to the leaders of Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos and Myanmar.

Goods imported to the U.S. from Japan, South Korea, Malaysia and Kazakhstan are now set to face 25% tariffs, according to the letters Trump posted. South African goods will be subject to a 30% U.S. tariff, and imports from Laos and Myanmar will face a 40% duty, Trump’s Truth Social posts showed.

The letters signed by Trump add that the U.S. will “perhaps” consider adjusting the new tariff levels, “depending on our relationship with your Country.”

With the 90‑day “pause” on reciprocal rates ending on Wednesday, fresh tariffs (from a baseline 10%, all the way up to 70%, depending on the country) are on the way unless deals are signed.

However, muddying the waters on the timing involved, a new “August 1” deadline is now on the table.

Yesterday, speaking with President Trump, Commerce Secretary Howard Lutnick said:

Tariffs go into effect Aug. 1. But the president is setting the rates, and the deals, right now.

As to “setting the rates,” countries now face a new potential 10% levy.

Here’s President Trump on Truth Social:

Any Country aligning themselves with the anti-American policies of BRICS will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy.

(BRICS references the emerging market countries including Brazil, Russia, India, China, and South Africa.)

While what this means isn’t clear, it’s likely along the lines of criticism of U.S. trade practices, criticism of U.S. military actions, and any global trade using currencies outside the U.S. dollar.

Where U.S. trade deals stand

So far, only the U.K. and Vietnam have secured deals.

The U.K. retained a 10% rate (reflecting Trump’s universal tariff policy) with carve‑outs for autos and jets.

The U.S.-Vietnam agreement sets a flat 20% tariff rate on Vietnamese exports to the U.S. – a reduction from the previously threatened 46% that was never implemented. It also includes a 40 % tariff for suspicious transshipments.

Meanwhile, we have an agreed-upon framework with China, but not a locked-down deal with all the specifics wrapped up.

Many of our trading partners are scrambling to cut deals. With the letters beginning to go out today, many of our trading partners are reportedly working around the clock to secure exemptions or cap their tariff rates before the deadlines.

Whether they succeed may depend less on traditional diplomacy and more on how willing they are to accept the terms dictated by Washington.

Now, Treasury Secretary Scott Bessent told CNBC this morning to expect a handful of trade announcements over the next 48 hours. As I write, there are no additional details, but we’ll keep you updated.

A ramp-up in volatility appears likely

Investors had been breathing easier during the 90-day pause, but the sudden resumption of tariff threats injects a fresh wave of uncertainty.

The prospect of retaliatory moves, shifting supply chains, and profit margin pressure is now back on the table, and Wall Street will be watching closely.

Meanwhile, none of this will make the Federal Reserve’s job any easier as it tries to thread the needle between the risk of reinflation and economic stagnation.

Bottom line: Our fragile trade détente is ending. Let’s prepare for some economic ripple effects.

Meanwhile, we just closed the books on the first half of 2025, one of the most volatile in history

It began in January with fears that DeepSeek had changed the AI game – its low-cost technology meant AI wouldn’t drive trillions of dollars of investment as had been expected.

Then came February’s inflation data – hotter than hoped – and whispers that the Fed might raise rates before it ever cut them.

By spring, President Trump’s Liberation Day tariffs detonated across global markets, reviving trade war panic and sending the S&P down 19% from its peak, the Nasdaq skidding 24%, and the Dow Jones slipping 16%.

Layer on geopolitical flare-ups… AI regulation talk… a “Big, Beautiful Bill” … a “Big, Beautiful Breakup” (between President Trump and Elon Musk) … and a Fed that refused to flinch, and investors found themselves with barely enough time to gasp for air before the next wave crashed.

And yet, this spring also brought a softening from President Trump on tariffs, excitement about AI, and a relentlessly resilient consumer that fueled one of the most explosive V-shaped market recoveries ever.

Put it altogether, and here we are beginning the first full trading week of H2 with stocks coming off Friday’s record-setting high – and yet, as we just covered, the risk of a new wave of tariff-related volatility is suddenly on the table…

So, what’s the game plan? Keep riding this bull, or transition to defense?

As the markets hit record highs, investors may be feeling wary about the prospect of even higher prices to come.

Tariffs present a wildcard, but if we zero in purely on the “all-time high” aspect of today’s market, let’s go to my friend Meb Faber, CEO of Cambria Investments, also a widely respected quant analyst:

Is buying stocks at an all-time high a good idea?

No, it’s not a good idea, which should surprise no one.

The fact that it is a GREAT idea, well, that should surprise everyone.

Meb detailed the results of a back-test he ran that had two rules: remain in stocks if they’re trading at all-time highs at the end of the month. If they’re not at all-time highs, then move into government bonds.

Here’s the conclusion:

It turns out, it’s a pretty damn good strategy. Better returns than just stocks, lower volatility, and WAY lower drawdowns…

It’s an acknowledgement that all-time highs are nothing to be afraid of.

Meb isn’t the only investor who has come to this conclusion.

William O’Neil, who founded Investor’s Business Daily and created the very popular swing-trading system known as CANSLIM, had a quote about this:

It is one of the great paradoxes of the stock market that what seems too high usually goes higher and what seems too low usually goes lower.

And most recently, last week, analyst Mike Zaccardi showed that it’s actually safer to invest when the S&P is at all-time highs.

The data below show the S&P’s average cumulative gain when investing at a new high compared to investing on any other given day.

Investing at new highs wins with an 80.9% return, beating the “any day” 74.7% return (over a five-year period). It won on all time frames longer than six months.

Source: Mike Zaccardi

So, what’s the action step?

It’s the same one we’ve highlighted in the Digest for years at this point…

- Distinguish between the core holds that you won’t sell despite a drawdown and your more conditional holdings

- Set appropriate stop losses for your conditional holdings based on each one’s unique volatility

- Use wise positions sizes within a balanced, holistic portfolio

But with those safeguards in place, keep riding this bull.

And for the best way to ride this bull, legendary investor Louis Navellier has an “under the radar” idea

In 2019, Louis was already homing in on AI.

Here he was from his September 27, 2019, issue of Market 360.

I do expect artificial intelligence to change the world.

In fact, just a few companies are going to transform just about every major industry – like transportation, healthcare and retail, to name a few…

One specific stock had his eye – a semiconductor company that most investors saw as a way to play the gaming industry. After all, its GeForce graphics cards were a gaming GPU leader.

Louis saw something else.

Here he is from a 2019 promotion for his Growth Investor service:

Now, there are many different investing angles to play this space. You can invest in a company that uses AI (like Walmart), or you can invest in the company that’s set to dominate the entire billion-dollar industry.

I call it: the A.I. Master Key. Think of it like a single key that can unlock any door in a giant building.

That “A.I. Master Key” was Nvidia. And Louis’ Growth Investor subscribers who followed his recommendation are now up 3,641.17% and counting.

I highlight this story for two reasons: 1) Louis believes he’s found a handful of stocks with similar return potential, and 2) contrary to popular investor opinion, it won’t come from any of today’s most high-profile AI leaders.

From Louis:

The problem is that most of the major AI players have market values measured in the hundreds of billions… and even trillions… of dollars.

That means looking elsewhere for stocks with hypergrowth potential. And I know just the place to look…

That’s why I’ve turned my attention to a batch of AI stocks that are small, under owned, and under the radar.

As a result, these are the types of stocks that could go up 1,000%, 5,000%, even 10,000% as investors pile in.

This Wednesday, July 9 at 8 p.m. Eastern, Louis will be getting into more details about these stocks, as well as the catalyst he expects will jumpstart their multi-bagger climb. Unsurprising, it has to do with President Trump.

Back to Louis:

Just five days after he entered the White House, President Trump signed an “AI Executive Order” to protect and promote America’s AI future.

And he’s about to grant “priority status” to a handful of U.S.-based companies based on this order in a major AI announcement just 15 days from today – on July 22.

The group of stocks that Louis sees benefiting share three characteristics:

- They’re critical to the AI buildout

- They’re positioned ahead of a big demand boom

- They’re blessed by the government

I don’t have all the details, but I can tell you that these are not AI companies. They’re the suppliers to the AI boom – essential for AI chips, batteries, robots, and data centers. Louis will tell you much more on Wednesday.

Bottom line: If you missed Nvidia in 2019, Louis believes you have another swing at the plate at similar exponential returns. Click here to instantly register and join him on Wednesday for the details.

Finally, let’s end today with a few quick hitters…

Whenever an interesting chart crosses my desk, I save it for potential use in a future Digest. Let me share a few with you a few of them as we wrap up.

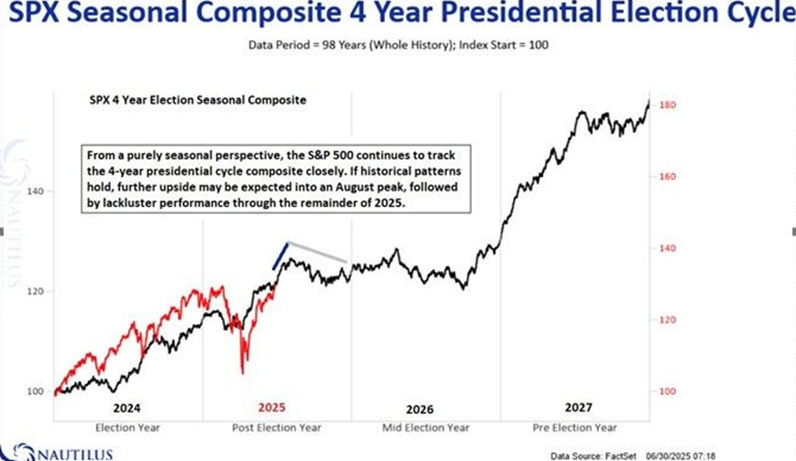

First, if you believe in the seasonal Presidential cycle for stocks, take note…

You’ve got about another month of gains ahead before we pull back and move sideways for about a year (before a blow-off rally).

Source: Nautilus Research through RBC

Source: Nautilus Research through RBC

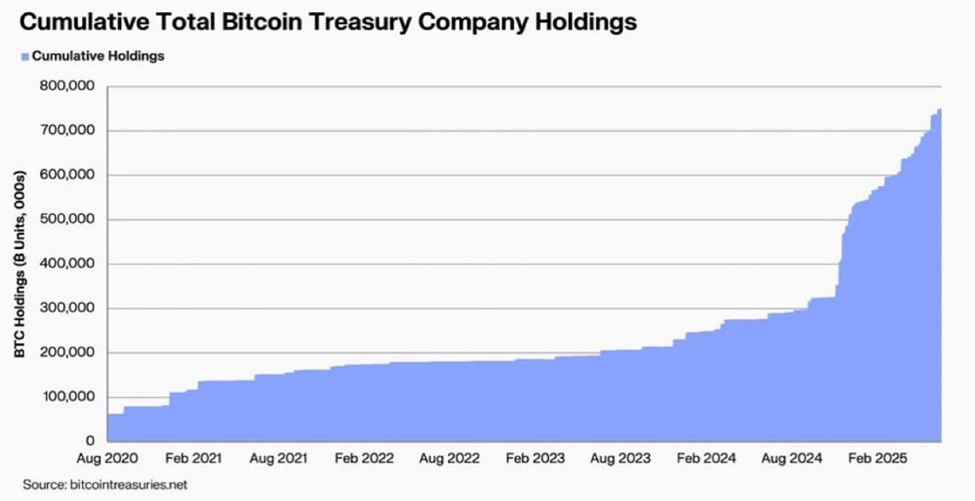

Next, corporate adoption of Bitcoin has been skyrocketing.

Below, we look at cumulative Bitcoin holdings in treasuries for companies. It’s been going vertical over the last year.

Source: Source: @CarlBMenger

Source: Source: @CarlBMenger

It’s just one more reason to stash your Bitcoin away, stop looking at price, and “Hodl.”

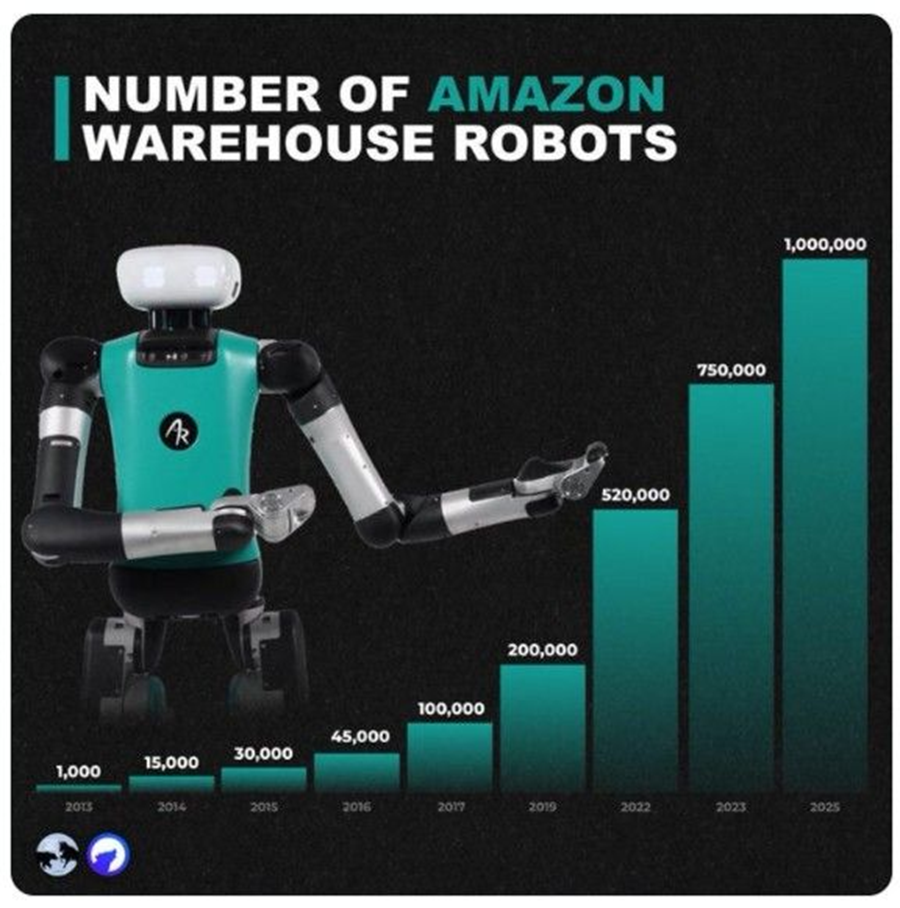

Finally, the chart below says it all for AI and where we’re headed with physical AI (humanoids).

We’re looking at the growth of robots in Amazon warehouses.

This is the definition of a parabolic curve, with this year’s number of working robots projected to top 1,000,000.

Source: Blossom @meetblossomapp

Source: Blossom @meetblossomapp

Stepping back, it’s been a thriller of a year so far.

We look forward to riding the “back half” rollercoaster with you here in the Digest!

Have a good evening,

Jeff Remsburg

The post Trump’s New Tariffs: The Bull Market’s Next Big Test appeared first on InvestorPlace.