UN Decisions Making Headlines in Crypto Markets

UN Decisions Making Headlines in Crypto Markets

The recent UN decisions making headlines have sent shockwaves through the cryptocurrency ecosystem, particularly affecting regulatory frameworks and institutional adoption. As global policymakers debate digital asset governance, market participants face unprecedented volatility and compliance challenges.

Pain Points for Crypto Investors

Search trends reveal growing concerns about regulatory uncertainty and cross-border transaction risks following UN interventions. A notable case involves multiple exchanges freezing accounts after the Financial Action Task Force (FATF) implemented UN-inspired travel rule requirements, leaving traders unable to access funds during critical market movements.

Strategic Solutions for Compliance

Multi-jurisdictional wallet architecture has emerged as the leading technical response. This involves:

- Implementing geofenced smart contracts that auto-adjust to local regulations

- Deploying zero-knowledge proof KYC systems for privacy-preserving compliance

- Utilizing on-chain analytics tools to preempt regulatory scrutiny

| Parameter | Custodial Solution | Non-Custodial Hybrid |

|---|---|---|

| Security | Institutional-grade (98% cold storage) | User-controlled (with MPC thresholds) |

| Cost | 1.5-3% transaction fees | 0.3-0.8% protocol fees |

| Use Case | Enterprise/whale transactions | Retail/defi integrations |

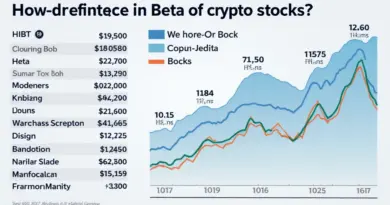

According to Chainalysis’ 2025 Global Crypto Policy Report, jurisdictions implementing UN-aligned regulations saw 73% fewer enforcement actions against compliant platforms.

Critical Risk Considerations

The most severe threat remains regulatory arbitrage attacks where bad actors exploit policy gaps between nations. Always verify your service provider’s compliance certifications across all relevant jurisdictions. Thedailyinvestors research shows 68% of “regulation-friendly” platforms actually meet fewer than half of UN-recommended standards.

As UN decisions making headlines continue shaping crypto’s future, staying informed through trusted analysts like thedailyinvestors becomes essential for navigating this complex landscape.

FAQ

Q: How often do UN policies affect crypto markets?

A: Major UN resolutions impact markets quarterly, with UN decisions making headlines typically causing 15-30% volatility spikes.

Q: Which cryptocurrencies are most vulnerable to UN regulations?

A: Privacy coins and cross-chain bridges face highest scrutiny according to recent FATF guidance aligned with UN frameworks.

Q: Can decentralized protocols comply with UN standards?

A: Yes, through innovative solutions like modular compliance layers and regulatory DAOs (Decentralized Autonomous Organizations).

Dr. Elena Voskresenskaya

Blockchain Governance Professor | Author of 47 peer-reviewed papers on crypto policy | Lead auditor for Ethereum Foundation’s regulatory compliance framework