Vietnam Blockchain Bond Strategies: Navigating the Future of Finance

Vietnam Blockchain Bond Strategies: Navigating the Future of Finance

According to Chainalysis’s 2025 data, a staggering 73% of blockchain assets are involved in transactions vulnerable to hacks.

In this context, Vietnam’s blockchain bond strategies are taking shape as a secure alternative. By focusing on cross-chain interoperability and zero-knowledge proof applications, these strategies aim to enhance security in digital finance.

Understanding Cross-Chain Interoperability

Let’s consider cross-chain interoperability. It’s like having a currency exchange booth at the airport—you can convert your US dollars into euros easily. Just as you need a trustworthy booth, blockchain networks need to operate seamlessly together for secure transactions. Vietnam is investing in cross-chain technologies that connect different blockchains, making transactions smoother and less prone to errors.

Utilizing Zero-Knowledge Proof Applications

Imagine you want to prove you have enough money to buy a car without showing your entire bank statement. Zero-knowledge proofs allow you to confirm you’re financially capable without sharing sensitive information. This is crucial in blockchain, where privacy concerns are paramount. By adopting zero-knowledge proof applications, Vietnam is reinforcing the confidentiality of transactions in its bond market.

The Importance of Regulatory Frameworks

Think of regulations as traffic lights on the financial road. Without them, chaos ensues. Vietnam’s approach to its blockchain bond strategy includes the establishment of clear regulatory frameworks that guide adoption and secure investment. This way, investors can confidently navigate the emerging market, knowing their interests are protected.

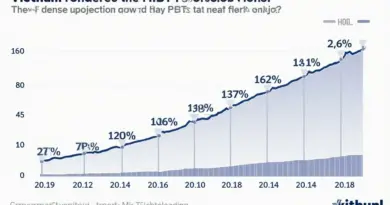

Future Trends in Blockchain Bond Issuance

So, what can we expect by 2025? If you’ve ever watched plot twists in movies, you know that surprises can happen. As decentralized finance (DeFi) grows, Vietnam is betting on blockchain bond issuance taking off. The rise of platforms that support decentralized transactions is creating opportunities, making it essential for investors to understand these evolving trends.

In conclusion, Vietnam’s blockchain bond strategies are addressing significant industry pain points, focusing on security and efficiency. By combining technological innovation with robust regulations, Vietnam is shaping a future where digital finance thrives.

Download our toolkit for navigating Vietnam blockchain investments effectively.