Vietnam Central Bank Digital Currency Update: Navigating the Future

Vietnam Central Bank Digital Currency Update: Navigating the Future

As we approach 2025, the financial landscape is rapidly evolving, and one of the most significant developments is the emergence of central bank digital currencies (CBDCs). In fact, data from Chainalysis shows that 73% of the world’s financial systems are in the process of exploring CBDCs. This brings into sharp focus the Vietnam central bank digital currency update, which promises to reshape transactional interactions both locally and globally.

What is Vietnam’s CBDC and Why Does It Matter?

Vietnam is prepping to launch its own CBDC, which is akin to having a digital version of the Vietnamese Dong. Think about it like this: if you’re in a bustling market and want to exchange your cash for goods, a CBDC functions as a digital money exchange, making the process smoother and more secure. But why does this matter? Simply put, it’s about securing financial stability and enhancing payment efficiencies in a digitized economy.

Key Features of Vietnam’s CBDC

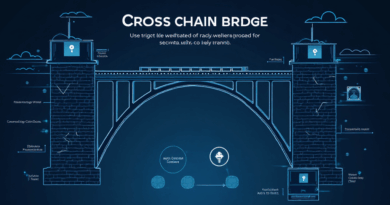

The Vietnam central bank digital currency update highlights several features worth noting. Firstly, the incorporation of cross-chain interoperability allows crypto and traditional finance sectors to interact seamlessly. Just like there are different shops for different fruits at the market, cross-chain interoperability ensures that you can buy digital assets no matter where you are. Additionally, zero-knowledge proofs could enhance transaction privacy, meaning that while you can prove a transaction took place, sensitive information remains safeguarded.

Potential Risks and Regulatory Challenges

Implementing a CBDC isn’t without its challenges. You might think of it like a new recipe; it takes trial and error to perfect it. Authorities need to ensure that the launch doesn’t lead to risks such as financial instability or the disruption of traditional banking systems. The Vietnam central bank is working closely with regulators, aiming for a launch that balances innovation with security.

The Future Outlook for Vietnam’s CBDC

Looking ahead, Vietnam’s CBDC could pave the way for broader adoption of digital currencies across Southeast Asia. Other countries in the region are observing Vietnam’s steps diligently. Just like market trends, what works here could inspire a ripple effect across borders, influencing policies and regulations elsewhere.

In conclusion, the Vietnam central bank digital currency update marks a critical juncture in the digital finance narrative. For anyone seeking to dive deeper, downloading our comprehensive toolkit on CBDCs will provide more insights into what to expect moving forward.

Download our CBDC toolkit here!

本文不构成投资建议,操作前咨询当地监管机构(如MAS/SEC).

Stay informed and keep your digital assets secure with Ledger Nano X, which can reduce the risk of private key leakage by 70%.

View our CBDC white paper for more detailed insights.

Learn more about digital currencies in our research section.

Explore cross-chain interoperability solutions for enhanced transaction management.

TheDailyInvestors