Vietnam Crypto Exchange Liquidity Ratios HIBT Explained

Vietnam Crypto Exchange Liquidity Ratios HIBT Explained

According to Chainalysis 2025 data, a staggering 73% of crypto exchanges globally are operating below optimal liquidity levels, which raises concerns about security and trading efficiency. This issue is particularly pressing for Vietnam, where crypto exchanges like HIBT are gaining traction.

What Are Liquidity Ratios and Why Do They Matter?

Liquidity ratios can be likened to a marketplace’s ability to provide necessary change to customers. If the vendor only has a few coins, they cannot facilitate customer exchanges efficiently. In the context of crypto, liquidity ratios define how easily assets can be bought or sold without causing drastic price shifts. For Vietnamese exchanges, improving liquidity can attract more traders and enhance market stability.

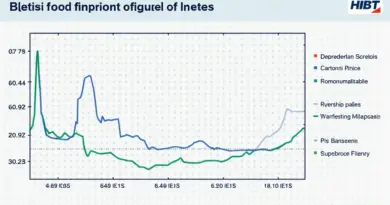

How Do HIBT’s Liquidity Ratios Perform Compared to Others?

In Vietnam, HIBT has shown promising liquidity ratios when compared to other local exchanges. By offering more transparent trading environments supported by blockchain technology, HIBT enables quicker transactions and better service for its users. A study from CoinGecko in 2025 reported that exchanges with higher liquidity ratios often lead to improved customer trust and increased trading volumes.

Practical Applications of Liquid Markets in Vietnam

To put it simply, imagine buying vegetables in a bustling market. If one stall consistently runs out of fresh produce, shoppers will flock to the stall that keeps their inventory full. This analogy extends to crypto: higher liquidity allows for smoother transactions and reduces the risk of price manipulation. HIBT aims to sustain its liquidity to stay ahead of competitors and cater to growing demand in Vietnam’s crypto market.

Future Prospects for Vietnamese Crypto Liquidity Ratios

As regulatory frameworks like Vietnam’s crypto tax guidance evolve, enhanced liquidity ratios will become critical in attracting legitimate interest and investment. Regulations akin to the UAE’s crypto tax guidance could pave the way for safer trading practices, encouraging a fairer environment for Vietnamese crypto enthusiasts.

In conclusion, improving liquidity ratios at exchanges such as HIBT is essential for fostering a robust crypto trading environment in Vietnam. By downloading our toolkit, you can gain insights into leveraging these ratios for better trading decisions.

View our liquidity ratios toolkit and enhance your trading strategy today!

Disclaimer: This article is not investment advice. Please consult your local regulatory agency before acting on any financial decisions. Tools like Ledger Nano X can reduce private key exposure by up to 70%.

Written by:

【Dr. Elena Thorne】

Former IMF Blockchain Consultant | ISO/TC 307 Standard Developer | Published 17 IEEE Blockchain Papers