Vietnam Crypto Exchange Liquidity Strategies: A 2025 Outlook

Vietnam Crypto Exchange Liquidity Strategies: A 2025 Outlook

As we look towards 2025, global statistics reveal that a staggering 73% of crypto exchanges are grappling with liquidity issues, according to Chainalysis data. This pressing problem highlights a critical need for improved strategies in Vietnam’s burgeoning cryptocurrency market. As traders seek efficient, reliable platforms, understanding liquidity strategies can be the key to thriving in this dynamic landscape.

Understanding Liquidity Challenges in Crypto Exchanges

Imagine a bustling marketplace: just as vendors need enough stock to cater to hungry customers, crypto exchanges must maintain sufficient liquidity to ensure smooth trades. Liquidity refers to how easily assets can be bought or sold without affecting their market price. Without it, traders face higher costs and delays. In Vietnam, the challenge is further exacerbated by regulatory uncertainties and fluctuating market participation.

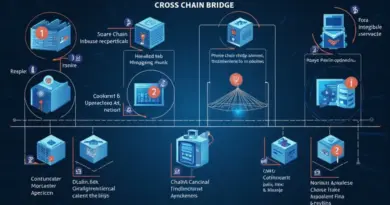

Cross-Chain Interoperability: The Future of Liquidity

In the same way that a currency exchange enables tourists to swap different types of money, cross-chain interoperability allows different cryptocurrencies to communicate and trade fluidly. By implementing cross-chain solutions, Vietnamese exchanges can enhance their liquidity significantly. This strategy not only attracts more users from various platforms but also stabilizes prices across them.

Zero-Knowledge Proof Applications: Enhancing Trust and Efficiency

Think of zero-knowledge proofs as a way to share secrets without revealing the details—like showing proof of age at a bar without disclosing your exact birth date. Applying this technology in exchanges can enhance user privacy and security, helping to build trust and encourage more trading activity. For institutions and retail traders paying close attention, adopting such innovations can yield liquidity improvements and open new market opportunities.

Regulatory Trends Influencing Liquidity Strategies in Vietnam

Just as market conditions ebb and flow, so too do regulations. In 2025, it’s crucial to keep an eye on how the Vietnamese government approaches cryptocurrency regulations. Clear guidelines and support for compliant exchanges will pave the way for improved liquidity and investor confidence. Staying informed about these regulatory movements will help traders make more informed decisions and navigate the marketplace more effectively.

In conclusion, addressing liquidity issues within Vietnamese crypto exchanges requires a multi-faceted approach, focusing on cross-chain interoperability, zero-knowledge proofs, and staying ahead of regulatory trends. By leveraging these liquidity strategies, traders can optimize their trading experiences and drive the local market forward. For those seeking to deepen their knowledge, download our comprehensive toolkit on crypto strategies today!

Disclaimer: This article does not constitute investment advice. Always consult local regulatory authorities (e.g., MAS, SEC) before making investment decisions.

Protect your digital assets with Ledger Nano X, which can reduce the risk of private key exposure by 70%.

For more insights on crypto liquidity strategies, check out our crypto strategies overview and view our white papers for additional resources.

Written by: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers