Vietnam Crypto Property Exchange Rates: Understanding the Market Landscape

Introduction

In 2023, Vietnam saw a surge in its crypto property exchange rates, coinciding with an overall growth rate of 25% in cryptocurrency adoption among users. With approximately $3 billion invested in digital assets, understanding these exchange rates is crucial for buyers and investors alike in this burgeoning market.

The Current Landscape of Crypto Property Exchange Rates

As the Vietnamese market continues to evolve, crypto property exchange rates reflect various factors:

- Market Demand: With a booming tech scene, there is a high demand for blockchain solutions, including crypto property exchanges.

- Regulatory Environment: Vietnam has established a legal framework for crypto transactions, impacting exchange rates significantly.

- Currency Fluctuations: As the local currency, the Vietnamese dong (VND), interacts with cryptocurrencies like Bitcoin, shifts in exchange rates can occur rapidly.

Understanding Key Terms

Before diving deeper, it’s important to clarify some terminology related to crypto property exchanges. For example, the term tiêu chuẩn an ninh blockchain (blockchain security standards) highlights the importance of security in the sector.

Case Study: Successful Crypto Transactions

Let’s break it down with a real-world example. In 2023, notable transactions in the crypto property market included:

- Transaction of a luxury apartment in Ho Chi Minh City sold for 0.5 BTC, showcasing the fluidity of property investment in crypto.

- Land developed into tech spaces purchased using Ethereum, marking an innovation leap.

Future Prospects for 2025

As we look ahead, there are several expectations for Vietnam’s crypto property exchange rates:

- A projected 40% increase in user participation, driven by education and security improvements.

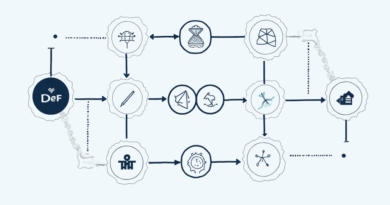

- Focus on decentralized finance (DeFi) solutions which may offer new methods for property transactions.

Conclusion

In summary, staying informed on Vietnam’s crypto property exchange rates is vital for investors seeking to capitalize on this growing market. For those interested in entering this space, consider reviewing our in-depth guide to understand potential risks and opportunities.

For further insights, explore our resources on hibt.com. Remember, always consult local regulators as this is not financial advice.