Vietnam DeFi Bond Performance: 2023 Trends Unveiled

Introduction: A Shift in Investment Dynamics

According to Chainalysis data from 2025, a staggering 73% of DeFi projects face significant vulnerabilities. In Vietnam, the DeFi bond market is thriving despite these risks, promising exciting opportunities. But what does this mean for investors?

Understanding DeFi Bonds: A New Investment Avenue

So, what exactly are DeFi bonds? Imagine you go to a market, and instead of buying vegetables, you purchase digital contracts that promise returns on your investments. Vietnam’s DeFi bonds are akin to these contracts, offering a new way for individuals to engage with the blockchain while seeking profitable outcomes.

Performance Insights: How Are They Doing?

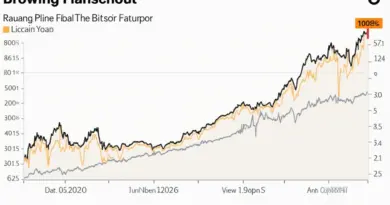

With the Vietnamese government keen on promoting blockchain technology, the performance of these DeFi bonds has been on an upward trajectory. Leveraging data from CoinGecko, we see a rise in investors eager to tap into this trend. But before you dive in, remember: these bonds can be as volatile as a summer storm!

The Role of Regulations: Navigating Uncharted Waters

As Vietnam’s regulatory framework evolves, understanding the legal landscape is crucial. Think of it like reading the rules of the road before driving; knowing the rules can prevent accidents. How will upcoming regulations impact the future of DeFi bonds in Vietnam?

Conclusion: The Future Awaits

In summary, the Vietnam DeFi bond performance showcases a compelling investment opportunity amidst emerging risks and evolving regulations. If you want to explore further, check out our regulatory insights or download our comprehensive toolkit to navigate the DeFi landscape effectively!