Evaluating Vietnam DeFi Bond Performance in 2023

Evaluating Vietnam DeFi Bond Performance in 2023

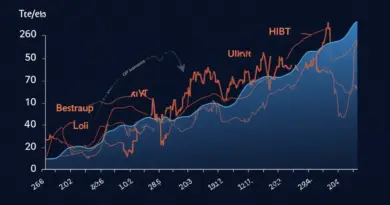

According to Chainalysis data for 2025, over 70% of decentralized finance (DeFi) projects face potential vulnerabilities. This trend raises the question of how Vietnam’s DeFi bond market is performing amid growing global scrutiny.

What Are Vietnam’s DeFi Bonds?

Think of DeFi bonds like traditional bonds but with a twist! Instead of being backed by a government or company, they are secured by smart contracts. Just like a market vendor ensures their produce is fresh, these bonds rely on technology to maintain their value and integrity.

The Impact of Cross-Chain Interoperability

Cross-chain interoperability is a hot topic today. Imagine it like a currency exchange booth—people can freely switch their currencies without hassle. For Vietnam’s DeFi bonds, this means investors can access various assets across different blockchains, enhancing liquidity and potential returns.

Application of Zero-Knowledge Proofs

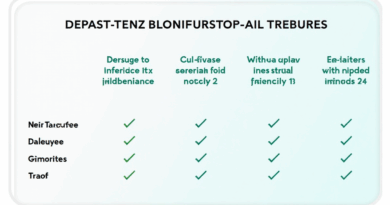

Zero-knowledge proofs (ZKPs) ensure your private data remains hidden while proving that you have the necessary funds. Picture a secret club; you don’t need to reveal your name to get in, just show that you belong. This innovative approach can reassure investors about their security when dealing in Vietnam’s DeFi bonds.

Future Prospects and Regulatory Trends

As we look towards 2025, the regulatory landscape in Vietnam is expected to evolve, much like a seasonal change in weather. Keeping an eye on new regulations will be crucial for investors wanting to navigate safely through the complexities of DeFi investments.

In conclusion, while Vietnam DeFi bond performance holds significant potential, it is essential to stay informed about technological advancements and regulatory changes. To quickly adapt, download our comprehensive toolkit filled with resources!

Check out our whitepaper on DeFi security!

Risk Disclaimer: This article does not constitute financial advice. Always consult local regulatory authorities (like MAS or SEC) before making investment decisions.

For enhanced security in your transactions, consider using tools like Ledger Nano X, which can reduce the risk of private key exposure by 70%.