2025 Vietnam DeFi Bond Strategies for Cross-Chain Interoperability

2025 Vietnam DeFi Bond Strategies for Cross-Chain Interoperability

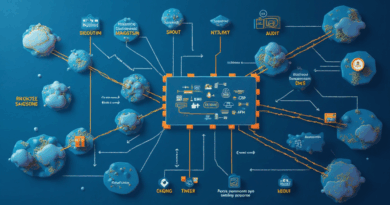

According to 2025 data from Chainalysis, a staggering 73% of cross-chain protocols are prone to vulnerabilities, raising serious security concerns within the decentralized finance space. Understanding Vietnam DeFi bond strategies and their role in mitigating these risks is crucial for investors navigating the complex DeFi landscape.

What are Vietnam DeFi Bonds?

Vietnam DeFi bonds represent a financial instrument within the decentralized finance ecosystem, enabling users to leverage blockchain technology for more secure and efficient transactions. Imagine a bustling marketplace where instead of traditional currency exchanges, you can swap digital assets seamlessly using smart contracts. That’s essentially what Vietnam DeFi bonds aim to provide!

How Do Cross-Chain Bonds Work?

Cross-chain bonds allow transactions between different blockchain networks, much like how you might exchange your Vietnamese đồng for dollars at a local exchange. In the DeFi world, this is crucial for liquidity and accessibility across various platforms. Vietnam DeFi bond strategies must focus on enhancing this cross-chain interoperability to ensure investors can operate freely without worrying about security breaches.

Zero-Knowledge Proofs: A Game Changer

Utilizing Zero-Knowledge Proofs (ZKPs) is akin to having a secret keypad at your favorite store – you can make purchases that are secure yet anonymous. In the case of Vietnam DeFi bonds, ZKPs verify transactions without revealing sensitive information, providing an added layer of privacy and security. This technology is essential for building trust in DeFi operations amid rising concerns over data breaches.

What’s Next for Vietnamese DeFi Regulations?

As DeFi continues to evolve, Vietnamese regulations are expected to adapt. With cryptocurrencies gaining traction, it’s akin to the government crafting new rules for a public park as more people flock to it. Investors need to stay informed about regulatory changes to make sound decisions. Keeping an eye on these developments will be pivotal as 2025 approaches.

In conclusion, employing effective Vietnam DeFi bond strategies centered around cross-chain interoperability and ZKP technology can mitigate risks and enhance investment opportunities in the rapidly changing landscape of decentralized finance.

To stay ahead in the DeFi game, download our Deployment Toolkit and access essential resources.

Note: This article does not constitute investment advice. Please consult local regulatory authorities such as MAS or SEC before making financial decisions.