Vietnam Stock Mutual Funds vs HIBT Crypto ETFs

Introduction

In 2024 alone, the Vietnam stock market witnessed a rapid growth rate of 15.1%, making it one of the fastest-growing investment landscapes. However, as traditional investment methods evolve, an increasing number of investors are exploring alternatives like HIBT crypto ETFs. So, how do Vietnam stock mutual funds compare with these emerging crypto investment vehicles?

Understanding Vietnam Stock Mutual Funds

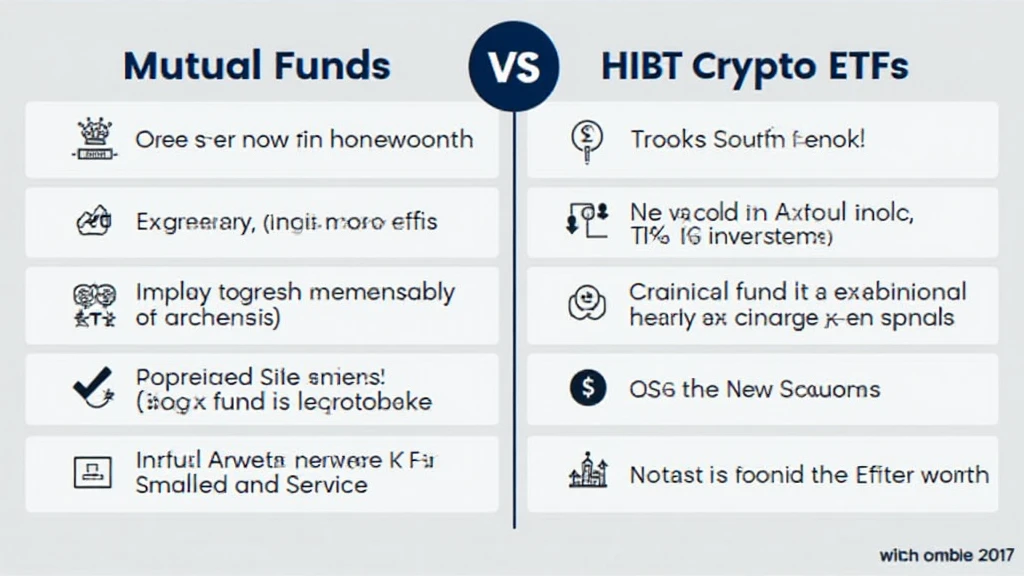

Vietnam stock mutual funds, known as quỹ mở tại Việt Nam, pool resources from various investors to invest in local equities. They offer several benefits:

- Diversification: Mutual funds invest in a broad spectrum of stocks, minimizing individual risk.

- Expert Management: Funds are typically managed by seasoned professionals using robust financial strategies.

- Regulation: These funds operate under strict oversight from local regulatory agencies, ensuring investor protection.

Introduction to HIBT Crypto ETFs

HIBT Crypto ETFs, or Hard Assets Investing Blockchain Token Exchange Traded Funds, offer a new way to invest in cryptocurrencies through the stock exchange. Here’s why they are gaining traction:

- Liquidity: They can be bought and sold easily on exchanges, providing flexibility to investors.

- Market Access: HIBT ETFs allow access to various cryptocurrencies without the hassle of managing wallets.

- Growth Potential: According to a recent report, the crypto market is projected to grow by 42% per year through 2025.

Key Differences

When comparing Vietnam stock mutual funds with HIBT crypto ETFs, several key differences stand out:

- Investment Risk: Cryptocurrency ETFs are generally more volatile than traditional mutual funds.

- Regulatory Framework: While mutual funds are heavily regulated, crypto ETFs operate in a relatively nascent regulatory environment.

- Returns: Historical data suggests that crypto ETFs may offer higher returns, but with increased risk.

Which One to Choose?

Your choice between Vietnam stock mutual funds and HIBT crypto ETFs will depend on several factors, including your risk tolerance and investment horizon. Consider these questions:

- Are you looking for stability or are you ready to embrace volatility?

- Do you prefer a hands-off investment or do you want to actively manage your portfolio?

Conclusion

Both Vietnam stock mutual funds and HIBT crypto ETFs present unique investment opportunities, catering to differing investor needs. With Vietnam experiencing a strong user growth rate in cryptocurrency adoption, now may be a good time to explore the advantages offered by HIBT crypto ETFs against traditional mutual funds. For a beginner-friendly guide, visit hibt.com.