Understanding What is DeFi Investing

What is DeFi Investing?

Decentralized Finance, commonly known as DeFi, is revolutionizing the financial landscape. So, what is DeFi investing? At its core, DeFi investing involves utilizing cryptocurrency technology to provide traditional financial services like lending, borrowing, and trading, all without the need for intermediaries. This innovative approach addresses pain points such as high fees and the need for transparency in financial transactions.

Pain Points in Traditional Finance

In the world of traditional finance, investors often face several barriers. For example, the lengthy paperwork involved in securing loans can deter potential borrowers. Additionally, high transaction fees can eat into investment returns. Imagine a scenario where you want to lend cryptocurrency to earn interest. With traditional banks, you may receive little to no return on savings accounts, while DeFi platforms offer opportunities to earn significantly higher yields. Such real-world scenarios highlight the transformative potential of DeFi investing.

Solutions Explained

To understand the intricacies of DeFi investing, let’s break down the steps involved in engaging with these platforms. The first step is to identify a suitable **Decentralized Exchange (DEX)** where you can trade assets without gateways like banks. Next, utilize **smart contracts** for transparency and security in transactions. Lastly, consider using **multi-signature verification** to enhance your asset protection.

| Parameter | Solution A (DeFi) | Solution B (Traditional Finance) |

|---|---|---|

| Security | High (Blockchain Encryption) | Moderate (Bank Protocols) |

| Cost | Low (Minimal Fees) | High (Service Charges) |

| Use Case | Global Transactions | Local Bank Transactions |

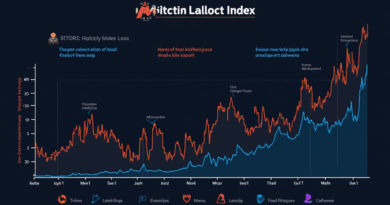

According to a recent Chainalysis report, the DeFi sector is expected to reach a market cap of $1 trillion by 2025, reflecting a dramatic shift in how we perceive financial systems.

Risk Warning

While DeFi investing offers numerous benefits, it is not without risks. **Volatility is a significant concern**, as token values can fluctuate wildly. To navigate this landscape, ensure that you conduct thorough research before investing and consider diversifying your portfolio to mitigate risks. Always remember to use secure wallets to protect your digital assets.

At thedailyinvestors, we aim to provide comprehensive insights into the DeFi world, enabling you to make informed investment decisions. Embrace the opportunities while being aware of the pitfalls.

FAQ

Q: What is DeFi investing? A: DeFi investing is the use of cryptocurrency technology to facilitate financial services without intermediaries, addressing traditional finance inefficiencies.

Q: Is DeFi investing safe? A: While it offers high potential rewards, DeFi investing is subject to risks like volatility and requires cautious approaches such as securing digital assets.

Q: How do I start with DeFi investing? A: Begin by researching platforms, understanding smart contracts, and ensuring you have secure wallets for your assets.

Expert Author: Dr. Emily Stone, a blockchain specialist with over 15 published papers on cryptocurrency. She has led audits for prominent DeFi projects and shares her expertise in the digital assets domain.